The almond industry is well positioned to move an anticipated third consecutive record crop as strong domestic demand and ideal growing conditions have converged to create a banner year for the almond industry.

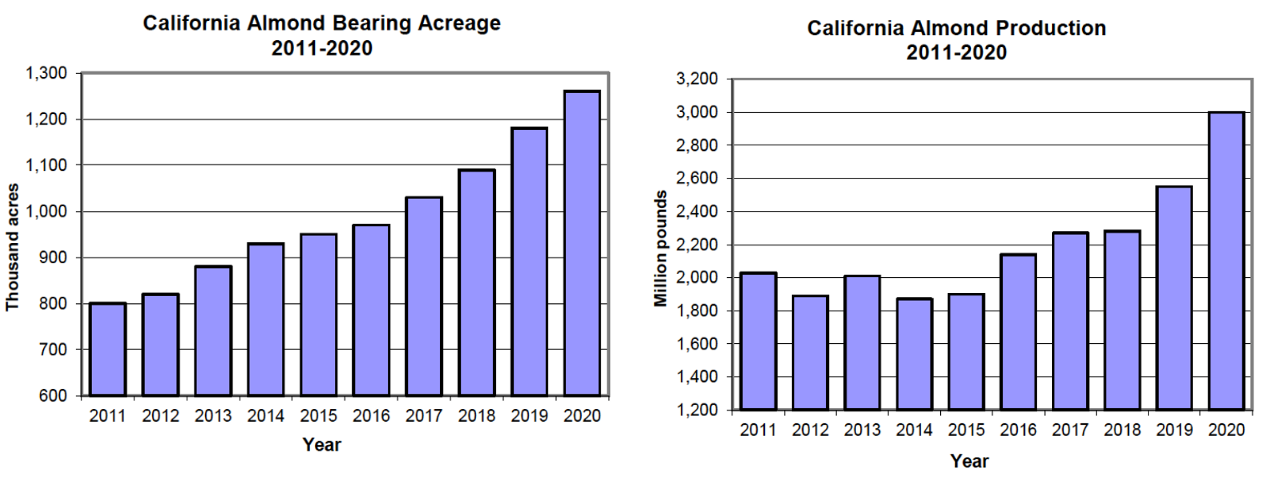

The USDA’s National Agricultural Statistics Service (NASS) in May released the 2020 California Almond Subjective Forecast predicting almond growers in California will produce 3.0 billion pounds of nuts. If realized, this production would constitute the third consecutive year of record production, reflecting increases in bearing acreage and an anticipated high per-acre yield of 2,380 pounds, up 10 percent over last year.

Banner Conditions, Banner Crop

Almond Board President and CEO Richard Waycott said the crop estimate came in higher than expected, thanks to a combination of orchard management improvements and mother nature.

“This (2,380 pounds per acre) is a big number, it’s on the high end of what was expected,” Waycott said. “For many of us, it’s the highest yield we have ever seen if you make adjustments to older NASS acreage that we think was understated.”

In contrast to recent seasons, almond growers this year enjoyed ideal pollination weather and growing conditions through May that were free of weather events that might impact production.

“So far this year we have seen pretty ideal pollination weather, subsequent good growing conditions and we have had adequate water up and down the state for producing the crop,” Waycott said.

In addition, over time, almond growers continue to plant higher density orchards and manage crops through fine-tuned irrigation, nutrient and pest management to optimize yields per acre.

The subjective forecast also projected preliminary bearing acreage for 2020 would hit 1.26 million acres, reflecting a continued annual increase of about 7 to 8 percent in bearing almond acreage.

The 2020 crop and acreage estimates represent the first year that NASS incorporated data gleaned from almond industry efforts to improve almond acreage estimates.

Industry Improves Crop and Acreage Estimating

The almond industry has been working with Land IQ to produce aerial satellite acreage surveys that can more accurately estimate bearing and non-bearing almond acreage based on physical assessments. Land IQ surveys estimate current bearing acreage at 1.26 million acres, which means there is consensus between Almond Board data and the numbers coming out of NASS, said Waycott. The Almond Board released both the Land IQ and the Almond Acreage Report together in April.

The Almond Board annually commissions NASS to produce four different estimate reports. In April, NASS releases the California Almond Nursery Survey, based on surveys and sales data from most major nurseries in California. This information, along with several other data points, including pesticide use reports and surveys of growers, goes into the concurrently released annual California Almond Acreage Report. Those reports are followed by the May California Almond Subjective Forecast, which estimates production for the coming year based on a survey of growers, and the final Objective forecast which is released each July to provide a revised estimate as the season progresses and is based on actual nut counts on trees. Each of those reports will also now include the physical survey data from Land IQ.

The 2019 California Almond Acreage Report released in April put 2019 bearing acreage at 1.18 million acres and total acreage for last year at 1.39 million acres.

Getting accurate data has been a priority of the Almond Board, Waycott said.

Industry leaders for years have questioned the accuracy of forecasted yield data coming out of NASS reports, suspecting that estimates of bearing acreage were being underreported, leading to an inflation in estimated per-acre yields. The physical observation data provided by Land IQ has helped increase the accuracy of acreage data.

“I think everyone is confident we have the right acreage numbers now,” Waycott said. “Since we started sharing Land IQ summary numbers with NASS in 2016, we are starting to see our numbers merge.”

Waycott said maintaining the integrity of the reports has been a priority for the Almond Board. Land IQ in 2018 created a “living map” of California almond orchards based on more than a decade of research, which the Almond Board expects will to at least 98-percent accuracy.

“We have improved the work we are doing with NASS and statisticians and looked at improving the fundamentals and methodology of the subjective estimate. We increased our grower sample size from 800 orchards to 1,000 and doubled the number of samples we are taking from each orchard. Now the yield component is the only variable,” said Waycott.

Strong Domestic Demand

Despite the production of a record crop amid a global pandemic, Waycott said almond handlers and marketers are well positioned to manage and sell the crop. Grower and harvesting operations have relatively low labor requirements and handling operations are also highly automated.

“With some adjustments for safety and health guidelines, things are operating pretty normally,” Waycott said.

Port operation glitches in the early days of the pandemic by May had normalized.

From a marketing standpoint, almond shippers saw a surge in domestic demand in the early days of the pandemic. March 2020 domestic volume was up 30 percent from the same time in 2019.

“That’s a surge we never see,” Waycott noted. “Position reports for April put domestic volume up 15 percent from last year, so we are continuing to see U.S. consumers buying more almonds at this time.”

That volume increase should help offset logistical difficulties in India, the leading export market for California almonds, or retaliatory tariff issues that are affecting demand in East Asia.

“The rest of the world regionally has increased over last year, so we are having a good year so far,” Waycott said. “We’re seeing some softening in certain places, but that is balanced by strengthening in others. This large crop estimate will provide a good opportunity for growth in consumption but it will and has also put pressure on prices.

“The resiliency of the almond industry is strong as ever as we think demand is also as strong as ever.”