The last several months have been nothing short of an economic roller coaster ride. The consumer has been bulk buying, causing a break down in the supply chain domestically and internationally. There was uncertainty in markets, and buyers were juggling supply and demand. The almond market has been fairing the storm and continues to make strides, though not without challenges.

“It has been a rough go,” said Paul Ewing, partner and grower relations manager for RPAC, an almond grower and processor in Los Banos, Calif.

Multiple elements play a role in the current state of the almond market and the future that will play out. According to Ewing, the uncertainty started last year, well before almond harvest of the 2019 crop.

“First of all, we need to look back at the 2019 July objective estimate at 2.2 billion pounds. People started doubting their ideas of what they thought was a 2.5 billion pound crop and they started marketing for a 2.2 billion pound crop. The prices last fall, getting this season going, were too high and didn’t stimulate enough demand growth. By December, we were getting surprised by the crop receipts every month. January came and the crop just kept getting bigger. A lot of the price decline came from the objective estimate being inaccurate and the crop actually being closer to 2.5 billion pounds,” said Ewing.

March 2020 brought the spread of COVID-19 and the crumbling economy that came with it. Combine the increase in yield growers had for the 2019 crop with impacts of COVID-19, and the almond market saw the decline no one could expect. There was a trade disruption internationally as well as domestically. Americans saw hoarding and stockpiling occurring, and the grocery store shelves empty. This same model occurred overseas as well.

“Economies closed down. Businesses had to shut down. There was a point in time where Indian buyers, for example, couldn’t operate their business and they weren’t going to the port to clear their containers,” said Ewing.

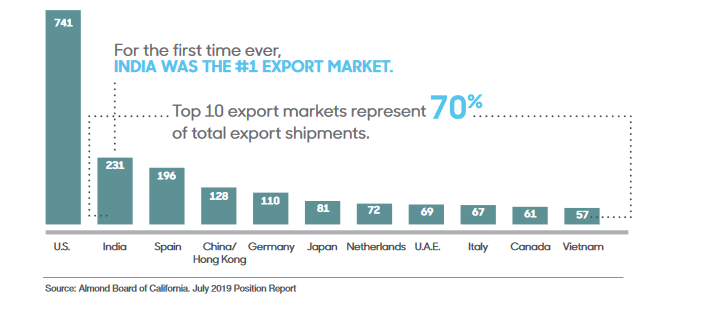

According to the Almond Board of California, shipments to India grew 16% in Fiscal Year 2018-2019. For the first time, India became the No. 1 export market of almonds, buying 231 million pounds. The industry predicted further increases with India this year. The Almond Almanac outlines almond consumption in India as strongly driven by tradition and many of those traditions were impacted by COVID-19.

“With the onset of COVID, India saw a reduction in weddings. Almonds are a customary gift during weddings, drawing a large reduction in demands across the country,” said Ewing.

The Almond Board of California’s India marketing program reinforces traditional uses in India as well as a focus on almond consumption as a snack.

The biggest issue with trade in India was getting product out of the port and into store shelves. Overall, demand remains strong, consumers just didn’t have product on the store shelf to purchase. Marketing efforts based on health, appear to be favoring the almond industry and consumer demand for product.

“Slowly they started to open up, but real consumption has slowed down a lot and buyers didn’t have the cash flow to purchase,” said Ewing. “Then a shut down in parts of the Middle East, like Dubai, came. Which did hurt their trade and lack of cash flow. At the same time, the U.K. and U.S. had a surge in shipments to refill those empty shelves. However, that has come and gone and shipments remain slow.”

He remains hopeful, however, that the agriculture economy will bounce back.

“It hasn’t been as big of growth as we like to see with the big crop we foresee coming,” Ewing said. “We believe that the growth is coming, as prices work their way down the chain and buyers work through some of the expensive inventory.”

He was hopeful the price will adjust, but expected it will take time. Growers have been here before, as prices change from a high to a low that wasn’t expected.

As the grower price fell below $1.60 a pound at the end of May, it was close or below growers’ breakeven point. Growers face tough decisions moving forward, Ewing said.

“We will likely see orchards being removed. The yield per acre is likely to drop next year. We won’t be surprised to see acreage decline,” he said.

Growers ultimately, have to do what’s best for their business. With older orchards at the verge or beyond the decline in yield, growers could be deciding to take orchards out of production early.

“There are positives in this situation, as well. We just have to choose to look for them,” according to Ewing. The price of almonds fell from $2.60 per pound at the beginning of the year down to $1.60 per pound at the end of May.

“Growers hope it doesn’t fall below that, but it is important to remember low levels spur demand. A lot of times we forget these tough times can bring an upswing in prices. For reference, during the 2015-2016 crop year, demand grew from 1.8 billion pounds to 2.1 billion pounds in shipments. The pricing dropped $1.70 from the high 2015 price above $4. That drastic drop in price grew demand back to a more stable price,” Ewing said. A stable price that almonds could very well be moving toward again soon with the onset of increased demand in the plant-based product sector.

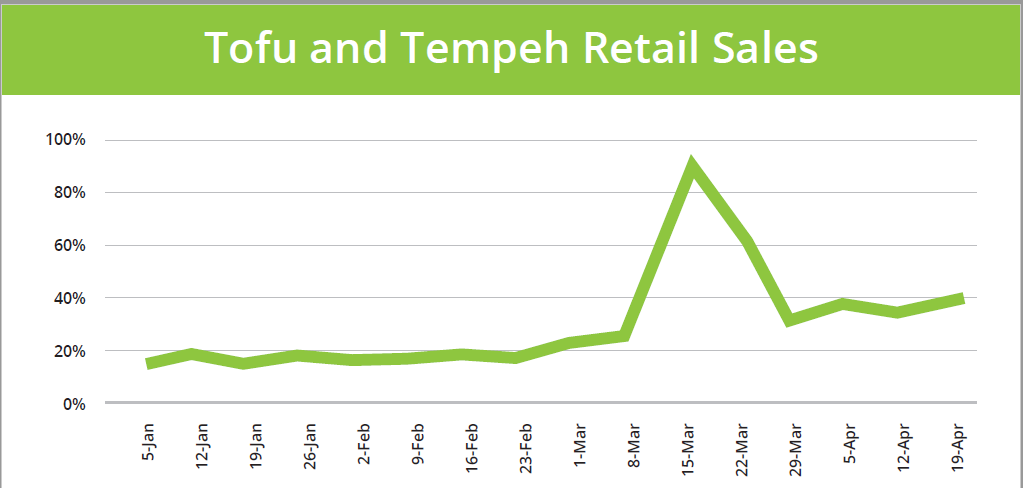

Some believe COVID-19 ramped up the demand for plant-based foods in their diets. According to the Plant-Based Food Association, “U.S. retail sales of plant-based food grew 11.4% last year to a record $5 billion.” This growth continued during the first part of this year as well.

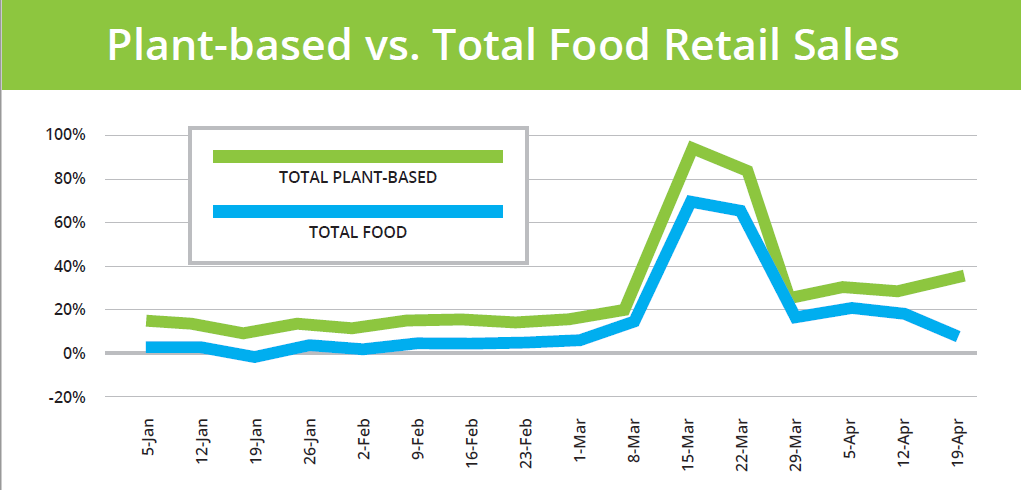

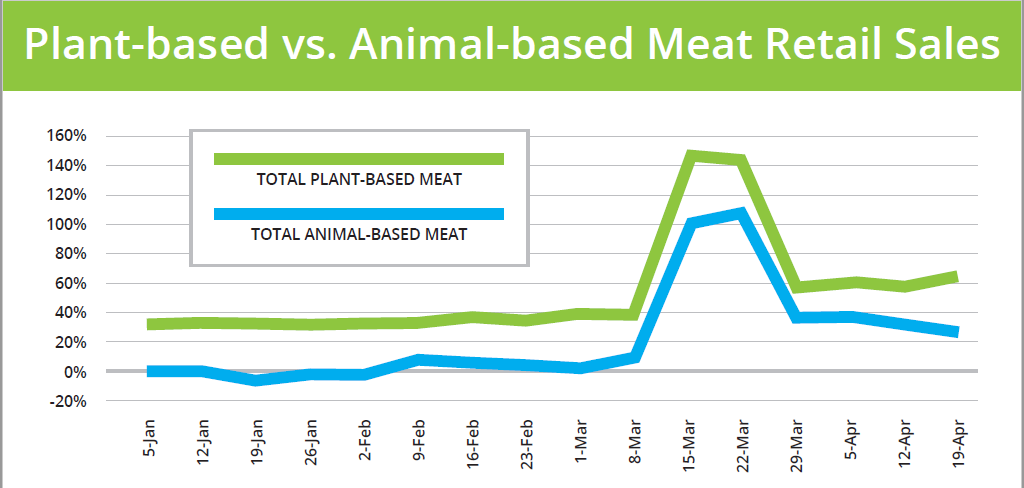

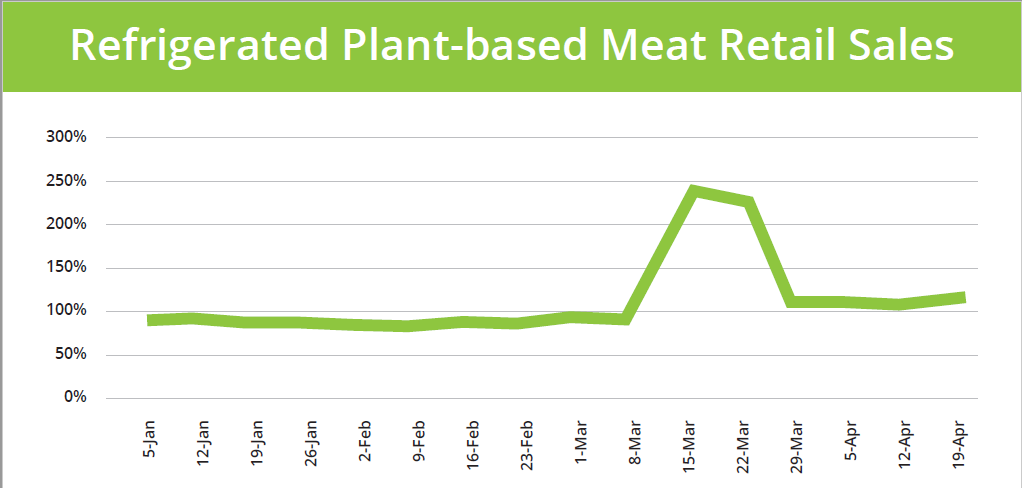

Plant-Based Food Association’s recent study shows a significant growth in the plant-based food category as this trend continues to climb. “Retail plant-based food sales, like other retail food sales, experienced a significant spike in mid-March during peak panic buying. During this time, plant-based foods were up a whopping 90% compared to last year’s sales. Throughout the four weeks following peak panic buying, total plant-based foods sales grew at 27%, which is 35% faster than total retail food,” the group said. With a projection continuing for plant-based food demand, it is hopeful almonds remain part of consumers’ top of mind.

Internationally, there is also growth to consider in China with their Phase 1 trade agreement scheduled to reach $36 billion in agriculture goods by December 2020. According to the USDA, “China is on the path for $13 billion of agriculture purchases between October 2019 and October 2020, putting them on the hook for the balance of $23 billion by December 2020 to uphold their end of the trade deal.” This forecast is not just crucial to agriculture in general, but largely to almond marketing as well.

As the third-largest international destination for almonds, China plays a massive role in almond exports. China’s growth and trade targets make them an ideal export partner going forward and a country with the potential for increased trade. The Almond Board of California’s current program in China focuses on highlighting the skin benefits of snacking on almonds.

The Almond Board of California stated, “With China’s $22 billion skincare market continuing to grow, it’s meaningful to consumers to know that the Vitamin E in almonds can be a helpful part of a skincare routine from within. Research reflects almond usage as a snack product had a 6% gain in consumption.”

Ewing referenced an increase in yield this year, noting “Combining the situation of COVID, very good bloom weather, we expected the north and east side to rebound from their low yields last year, but we didn’t expect the south and west side to come back with a strong crop this year as well. We aren’t sure until we get real data at harvest.”

Only time can tell where the almond price will lead and the future growth of the industry. Demand appears healthy and Ewing remained hopeful the price will improve. So, while there may be some uncertainty in this roller coaster ride, there are several pieces in place for a smooth landing.