The year 2020 has certainly been interesting on many accounts. It started off well for almond growers with near-perfect pollination weather in February, promising a large almond crop. Things changed quickly following almond bloom as the world shut down due to COVID-19. In this article, information is provided that will be useful as growers begin to settle their agreements for the 2021 almond pollination season.

Almond Industry Update

Currently, almond prices are hovering around $1.50-$2.00/lb., depending on variety, which is roughly 30% below their five-year average of $2.90/lb. Due to the increasing demand for almond pollination services over the past two decades, pollination costs now represent a substantial share of annual operating expenses for almond growers, rivaling both harvest and irrigation costs (Champetier, Lee and Sumner, 2019). Tight profit margins mean almond operations will closely scrutinize any production expenses, and will likely look closely into their pollination expenses as they establish contracts in the coming months as a consequence.

There has been much interest in recent years in planting self-compatible almond varieties (Independence and Shasta) as a way to decrease pollination and other production expenses. In 2020, an estimated 7% of bearing almond acreage in California was in self-compatible varieties, but in 2019, self-compatible varieties represented 21% of new plantings. Recently, an article published in Nature found the Independence variety showed an increase in yield by 20% from allowing bee visitation (Sáez et al. 2020). This study eliminates any claims that these self-compatible varieties do not require honey bee colonies for commercial production.

Colony Demand and Shipments

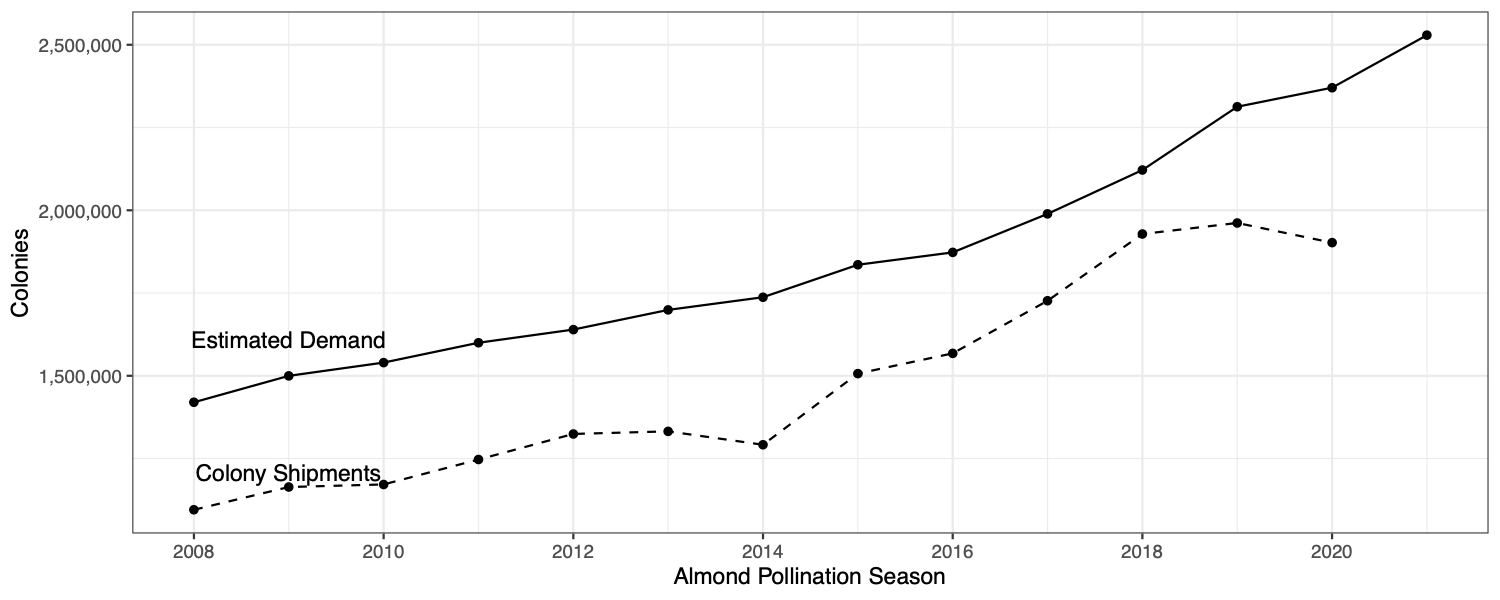

Figure 1 plots the estimated demand for colonies based on bearing almond acreage each year compared with total colony shipments into California. Estimated demand is calculated using 2 colonies per acre for traditional varieties and 1 colony per acre for self-compatible varieties. There is consistently a gap between estimated demand and colony shipments which is filled by colonies that remain in California year-round.

For the 2020 almond bloom, roughly 1.2 million almond acres required an estimated 2.4 million honey bee colonies for pollination. According to apiary shipment data provided by the California Department of Food and Agriculture, 1.9 million honey bee colonies were shipped into California from other states for the 2020 bloom; this was down 3% from 2019. For those who remember, 2019 likely required more colonies due to the rainy, cold weather compared with the 2020 bloom’s warm and sunny weather. In February 2021, an estimated 2.5 million colonies will be required for almond pollination. This amounts to approximately 88% of the total colonies in the U.S. on Jan. 1, 2020.

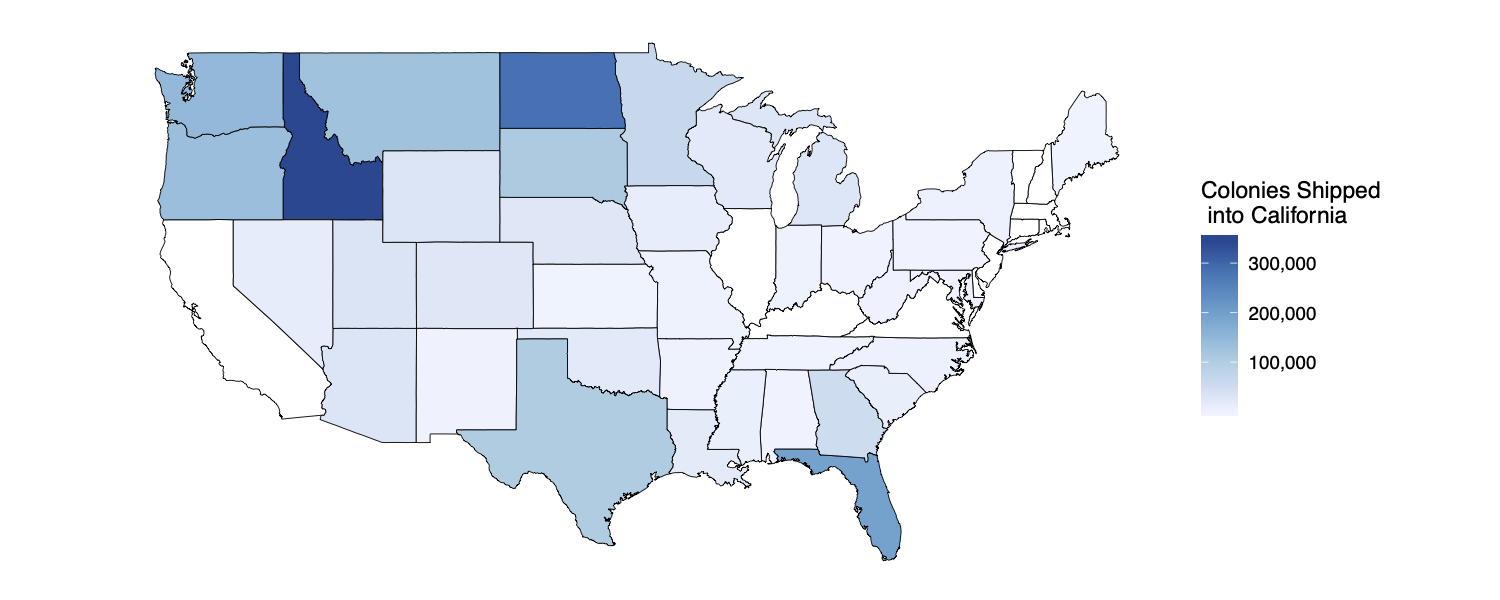

Idaho, North Dakota and Florida remained the top three states shipping colonies into California (Figure 2) Many honey bee colonies are transferred from the Northern Great Plains to the Pacific Northwest after honey production is finished to be held (often indoors) until almonds bloom in California. So, even though Idaho looks like the top shipping state according to CDFA border shipment data, many of those colonies in reality are coming from elsewhere. The shipment of colonies to storage in the Pacific Northwest is a trend that looks to continue into the future. Many beekeepers have seen lower mortality rates from storing colonies indoors over the winter.

Weather Impacts on Colony Supply

The 2020 season has seen a number of weather incidents that have the potential to impact colony populations and overall colony health. By mid-September, over 3.4 million acres had burned due to wildfires in California while over 1.5 million acres had burned across Oregon, Washington and Idaho. During July to Sept. 2019, up to 1 million colonies were located in these states, roughly half of what is required for almond pollination. It is unclear how many of these colonies have been (or will be) impacted by the wildfires, but the wildfires have the potential to severely impact beekeeping operations in these areas as well as the 2021 supply of colonies for almond pollination.

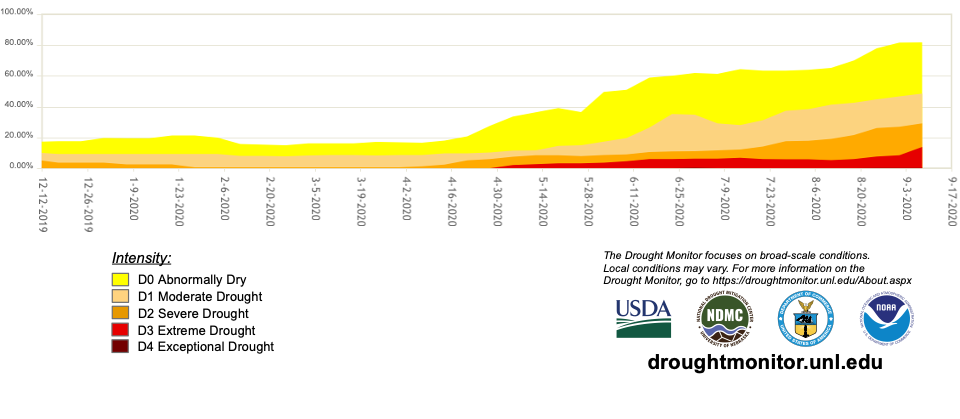

Most colonies in the U.S. spend their summers in the Northern Plains where abundant forage leads to large honey yields and healthy colonies. However, the Northern Plains may not have been its usual haven for honey bee colonies this year. Figure 3 (see page 16) shows the percentage of area in the Northern Plains (Montana, Wyoming, Colorado, Nebraska, South Dakota and North Dakota) that was abnormally dry or in worse drought conditions. At the beginning of June, 36% of the Northern Plains was at least abnormally dry. By the beginning of July, this number had increased to 62%, with 12% of the total area in a severe drought. It is possible honey flow in this area was affected, which ultimately may impact the health of colonies going into 2021.

Another natural disaster, Hurricane Laura, devastated parts of Louisiana and Texas in August. These states supplied at least 6% of the colonies for almond pollination in 2020. Hurricane Sally was not as strong as Hurricane Laura, but still caused extensive damage in parts of Alabama and Florida in September. These states supplied at least 10% of colonies for almond pollination in 2020. The impact of these hurricanes on colony supplies may be minimized because they occurred at times when many colonies were likely still in the Northern Plains for honey production.

Almond Pollination Fees

This article was written early enough that the 2020 California State Beekeeper’s Association (CSBA) pollination fee survey was not yet available, so fees cannot be reported from the 2020 almond pollination market (which would have included projections for 2021.) However, what is likely the largest survey of pollination fees to date is currently available. In December 2019-February 2020, researchers at UC Davis and Duke University conducted an online survey of over 300 almond growers to better understand pollination decisions. The sample represented roughly 14% of almond acreage in 2019.

Seventy-five percent of growers who rented colonies in 2019 provided the minimum colony strength requirement associated with their largest almond pollination contract. Table 1 (see page 17) shows the average almond pollination fee by the minimum average frame count requirement for growers’ largest pollination contracts in 2015 and 2019. Pollination fees from 2015 were converted to 2019 dollars to adjust for inflation. The 2015 data come from a survey conducted at the 2015 Almond Conference (Goodrich, 2019). The 2015 survey has a smaller sample size than the more recent survey; however, paired together these surveys provide the first documentation of how fees have changed across colony strength categories over time.

Across both surveys, the 8-frame minimum average frame count was the most frequently used colony strength requirement. In the 2019 survey, nearly a quarter of respondents who used colony strength requirements used a 6-frame minimum average, compared to only 7% in the 2015 survey. This shift could signal an increase in popularity of 6-frame requirements over time or may be due to the small sample size of the 2015 survey.

It is clear across both surveys that pollination fees increase as the colony strength requirement increases. In 2019, the average premium associated with strong colonies (>8-frame average) compared to 8-frame colonies was 6.2%; 6-frame colonies were discounted on average by 1.7% compared to 8-frame colonies, and weak colonies (<6-frame average) were discounted on average 3.1% compared to 8-frame colonies.

Across all colony strength requirements, inflation-adjusted pollination fees increased by 5% between 2015 and 2019. This varied by category; the highest colony strength requirement of a minimum average above 8 frames increased by 9.4% on average, while the smallest colony strength requirement of less than 6 frames increased by 4.2%. The premiums associated with the highest colony strength category went from 2.3% to 6.2% above the 8-frame minimum average. This increase in premium could reflect either increased input costs associated with supplying high strength colonies, and/or an increase in the demand for high strength colonies relative to 8-frame colonies.

The 2019 CSBA survey included projections for 2020 almond pollination fees. On average, the projected 2020 fee was $200 per colony. Despite the slight increase in demand for colonies, we don’t anticipate much difference between the 2020 and 2021 pollination fees, largely due to growers feeling the pressure of low almond prices. So, assuming the average fee for 8-frame colonies is $200 in 2021, based on the premiums in Table 1, larger than 8-frame colonies will rent for approximately $212 per colony, 6-frame colonies will rent for $195 per colony and less than 6-frame colonies will rent for $189 per colony. Those are rough estimates based on many assumptions, so take them with a grain of salt. Additionally, if any of the supply issues discussed in the previous section materialize into significant colony losses, colonies could become harder to acquire and fees could increase substantially from 2020 levels.

For more discussion of the survey findings, see Goodrich and Durant (2020).

Hive Density, Colony Strength and Crop Insurance

Because growers may be looking to cut pollination expenses this year due to low almond prices, the relationship between colony strength, hive density and crop insurance requirements is important. Beginning in 2013, USDA Risk Management Agency (RMA) and the Federal Crop Insurance Corporation (FCIC) began allowing for substitution between colony strength and hives per acre in their almond crop insurance policy.

The current policy document states as a guideline that a producer should have at minimum two colonies with 6 active frames, or its equivalent (USDA, 2018). Technically, that means one 12-frame colony per acre or 1.5 8-frame colonies per acre would satisfy this requirement. Almond growers can even deviate from this standard as long as they have consistently been using the same number of hives per acre and colony strength requirements and have had consecutive non-loss years. This flexibility in the policy allows growers to capitalize on benefits from self-fertile varieties that require fewer colonies per acre.

Oftentimes, growers focus on trying to lower the per-colony fee to cut pollination expenses. This may not be the best place to cut costs given the uncertainty in the supply of honey bee colonies. By trying to get the lowest fee possible, growers often end up with an unreliable beekeeper or colonies with very low strength.

In past years, if you have been contracting for more than the crop insurance minimum of 12 active frames per acre, you might consider adjusting either your colony strength requirements or hive density. Your beekeeper might be open to contracting for a 6-frame average this year rather than an 8-frame average for a lower per-colony fee. Or you might adjust from using 2 colonies per acre at an 8-frame average, to the 1.5 colonies per acre required by crop insurance at that colony strength. Before substantially changing your hives per acre and/or colony strength requirements, it is recommended that you check with your farm advisors and crop insurance agent to make sure it won’t cause any problems with yields or crop insurance payments.

There are other ways to lower pollination expenses that won’t impact the number of bees per acre. Negotiating with your beekeeper to pay a portion upfront for a lower fee is one option. Providing bee holding yards before bloom, locked gates in orchards or some other benefit to the beekeeper/pollination broker may also get you a lower fee, though don’t count on substantial cuts.

Conclusions

In 2021, low almond prices will likely have growers wanting to cut expenses wherever possible. When settling almond pollination agreements this fall, we encourage growers to remember that almond pollination requires most of the honey bee colonies in the U.S., so reliable pollination providers are important. If you have a good relationship with your beekeeper, don’t risk this year’s fruit set by trying to find someone who will offer you the lowest price. Communicating with your beekeeper and paying them a fair price for their colonies will likely ensure a secure supply of pollination services in the years to come.

References

Champetier, A., H. Lee, and D.A. Sumner. 2019. “Are the Almond and Beekeeping Industries Gaining Independence?” Choices. Quarter 4. Available online: http://www.choicesmagazine.org/choices-magazine/theme-articles/pollination-service-markets-evolution-and-outlook/are-the-almond-and-beekeeping-industries-gaining-independence

Goodrich, B.K. 2019. “Contracting for Pollination Services: Overview and Emerging Issues.” Choices. Quarter 4. Available online: http://www.choicesmagazine.org/choices-magazine/theme-articles/pollination-service-markets-evolution-and-outlook/contracting-for-pollination-services-overview-and-emerging-issues

Goodrich, Brittney K. and Rachael E. Goodhue. “Honey Bee Colony Strength in the California Almond Pollination Market.” ARE Update 19(4) (2016): 5-8. University of California Giannini Foundation of Agricultural Economics. http://giannini.ucop.edu/publications/are-update/issues/2016/19/4/honey-bee-colony-strength-in-the-california-almond/

Goodrich, Brittney K. and Jennie L. Durant. “Going Nuts for More Bees: Factors Influencing California Almond Pollination Fees.” ARE Update 24(1) (2020): 5–8. University of California Giannini Foundation of Agricultural Economics. http://giannini.ucop.edu/publications/are-update/issues/2020/

Sáez, A., Aizen, M. A., Medici, S., Viel, M., Villalobos, E., & Negri, P. (2020). Bees increase crop yield in an alleged pollinator-independent almond variety. Scientific reports, 10(1), 1-7. http://www.nature.com/articles/s41598-020-59995-0

U.S. Department of Agriculture. 2018. Almond Loss Adjustment Standards Handbook 2019 and Succeeding Crop Years. Washington, DC: U.S. Department of Agriculture Federal Crop Insurance Corporation and Risk Management Agency, FCIC25020 (10-2018).