California tree nut producers were among the biggest losers of the trade war that began under the Trump Administration, a UC study has found.

In fact, California’s farmers and food processors were hit harder than their counterparts in any other state. And, despite compensation from USDA’s Market Facilitation Program, most California farmers were not made whole by the aid, said lead author Colin A. Carter, a Distinguished Professor of Agricultural and Resource Economics at UC-Davis.

“California’s losses from the trade war far exceeded the government compensation payments,” Carter noted.

The study, “2018 Trade War, Mitigation Payments, and California Agriculture,” was released in late 2020. Jiayi Dong, a doctorate student at UC Davis, and Sandro Steinbach, an assistant professor at the University of Connecticut, co-authored the report with Carter.

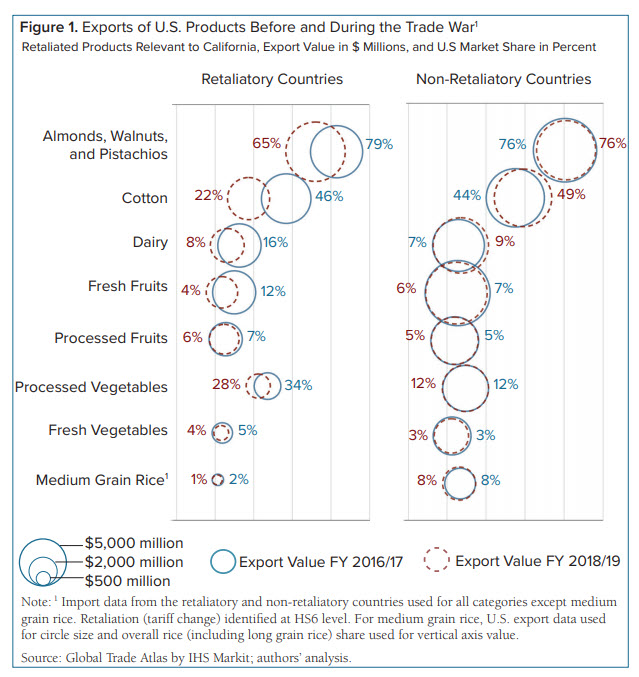

Before the trade war, California’s share of the tree nut market in China had been growing rapidly. But almost all California products exported to China— one of the world’s largest importers of agricultural products—lost significant market share due to the trade war and resulting retaliatory tariffs. The U.S. market share for almonds, pistachios and walnuts fell from 94% to just 53%.

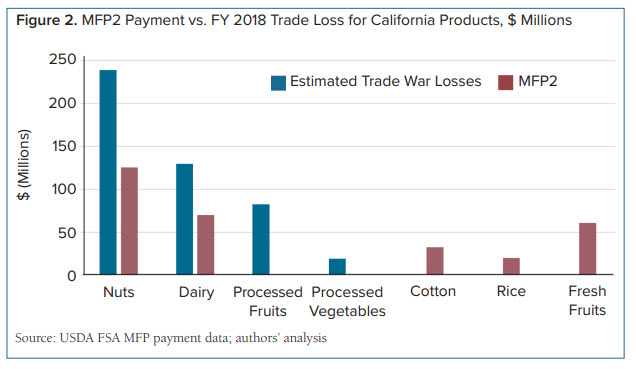

Overall, tree nuts suffered substantial trade war losses of about $239 million, with the MFP payments accounting for just 52% of the loss, the report found.

The Imbalance of MFP Payments

President Trump launched the trade war against China in 2018, protesting unfair trade practices by the Asian superpower. The U.S. imposed tariffs on more than $550 billion of Chinese products. China retaliated with tariffs on more than $124 billion of U.S. goods between July 2018 and August 2019. The result? U.S. farmers lost billions of dollars in export sales to China due to retaliatory tariffs, according to the report.

“The trade war caused economic pain on both sides of the dispute,” said Carter, who holds a doctorate in Agricultural Economics from UC Berkeley.

The 2-year MFP distributed $8.6 billion in 2018 and $14.4 billion in 2019. The direct payments went to farmers who were considered financially harmed by trade war disruptions and tariffs. But the reality was that the MFP payments were “mostly about political patronage, especially for producers of certain commodities in certain states,” the study’s authors noted.

During its first year, MFP covered five non-specialty crops: corn, cotton, sorghum, soybeans and wheat. The program also provided payments to the specialty crops of fresh sweet cherries and shelled almonds. Dairy and hogs were also eligible for MFP subsidies.

MFP’s second year “greatly inflated payments compared to 2018,” said Carter.

In 2019, MFP’s commodity coverage expanded to 27 non-specialty crops, including grains, oilseeds and cotton. It also increased the number of specialty crops, expanding coverage to non-shelled almonds, fresh grapes, pecans, pistachios and walnuts. Dairy and hogs remained covered.

Under 2019’s MFP, California farmers received a total of about $355.4 million. That amounted to about $31,733 per eligible farming operation. Yet California’s MFP payments were small compared to the state’s share of ag commodities impacted by the trade war and the losses incurred, the report pointed out. The Golden State’s losses during the trade war’s first year of 2018-19 reached $875.1 million, while both years of MFP payments totaled just $451.4 million—$96 million for 2018 and $355.4 million the next year.

“So even if we combine the MFP compensation for two years, it’s only about one-half of the California trade losses in a single year,” Carter said.

California farmers were undercompensated compared to producers in the Midwest and the southern U.S., he added. While nuts and dairy failed to receive adequate compensation, commodities such as rice and cotton were overpaid. Processed vegetables and fruits received no payments at all.

U.S. Food and Ag Hit Hardest

Of all retaliatory tariff impacts against the U.S. from the trade war, the agricultural and food industry was affected more than any other sector of the economy, the report said. In all, 908 U.S. ag and food products were targeted for retaliation, encompassing more than $31.9 billion in U.S. exports. China imposed retaliatory tariffs on almost all U.S. agricultural and food products. Canada, Mexico and the E.U. also levied higher tariffs on a variety of American goods. Turkey also raised import duties on several products, including tree nuts.

“We calculated that the average foreign tariff on U.S. agricultural and food products increased from 8.3% to 28.6%,” Carter said.

The biggest impact for the ag and food sector occurred with China. U.S. agricultural exports to China fell 53% between 2017 and 2018. That opened opportunities for other countries to capture market share.

“Before the trade war, California was the major exporter of walnuts to China, but with the retaliatory tariffs, China shifted to Chile and Argentina for imported walnuts,” noted Carter.

Australian almonds and walnuts and Iranian pistachios also gained from the Chinese tariffs against the U.S.

Trade War Today

By May 2019, ongoing negotiations helped lighten several retaliatory tariffs. Canada and Mexico lifted their import duties to clear the way for the ratification of the United States-Mexico-Canada Agreement as the U.S. removed its tariffs on steel and aluminum imports from its two neighbors. The U.S. and China reached a phase-one trade deal in January 2020 that’s expected to ease tensions with China’s commitment to significantly increase imports of American bulk products such as corn and soybeans.

But difficulties remain, the report’s authors said.

“California’s producers focus on high value-added products and have a significant stake in reducing trade barriers everywhere, and in particular in China,” said Carter. “The MFP payments may have jeopardized international trade arrangements because the excessive payments violated U.S. farm subsidy commitments to the World Trade Organization.

“Several countries are considering a challenge at the WTO in opposition to these huge payments,” he concluded. “This dispute could cause the effects of the trade war to drag on.”

Read the full report at giannini.ucop.edu/publications/are-update/issues/2020/24/2/2018-trade-war-mitigation-payments-and-california/.

The Trade War Drags on for U.S. Pistachios, but Business is Looking Up

For the U.S. pistachio industry, the most significant tariff issue continues to involve China.

“China was our No. 1 export destination but has dropped to No. 2 as a result of the tariffs,” said Richard Matoian, president of American Pistachio Growers. “We still have the same tariffs in place today as we’ve had for the last year: 50% on raw pistachios and 30% on roasted.”

In 2020, the higher tariffs plus COVID-19 restrictions disrupted the normal supply chain between the U.S. and China. Fewer containers were making their way to American shores.

“This caused a large increase in prices for containers, if you could find them when you needed them,” Matoian noted.

Additionally, Iran’s improved crops between 2018 and 2020 allowed the Middle Eastern country to replace U.S. pistachios in China.

“While U.S. product may have certain quality and consistency advantages, it’s difficult to compete in any market when a tariff is imposed only on your product,” Matoian said.

President Biden had spoken with Chinese President Xi Jinping, added Matoian, but no tariff reductions have been announced by either side. In fact, President Biden was quoted as saying the tariffs will remain in place.

Even so, as of late February, U.S. pistachio business with China was picking up.

“Shipments to China for the current crop year, starting September 1, 2020, are up 16% year over year, so things are better than last year,” Matoian said. “Overall, exports to date are up 18.5% over the same time last year.”

Retaliatory Tariffs on California Walnuts Remain in Place

The global market is critical to California’s walnut industry, which exports 60% of its crop. But growth in foreign markets slowed after key buyers like China, India and Turkey imposed retaliatory tariffs.

How has the walnut market fared this year? The California Walnut Commission’s Pamela Graviet, senior marketing director, international, gave this update:

Have things improved with the trade war, retaliatory tariffs and the walnut industry?

Tariff rates and retaliatory tariffs that have been imposed on California walnuts and other commodities remain in place. Through other USDA programs designed to help mitigate the impacts of tariffs, including the Agricultural Trade Promotion Program, the CWC has expanded its marketing activities in both directly tariff-affected countries as well as other markets. This program has been instrumental in helping to both establish and maintain positive relationships in foreign markets despite tariff actions. The CWC will continue its advocacy with USTR, USDA, local representatives and other U.S. governmental agencies to keep them abreast as to how these high tariffs are having a continued negative impact while advocating for fair trade for the industry.

Are California’s walnuts regaining export markets lost during the trade war?

Tariffs are only one component facing the California walnut industry, and importers have responded accordingly. This crop season, we have seen shipments to some key tariff-affected markets, including India and China, rebound as overall market price is very low and consumer demand for nuts in general has increased globally. However, China is unlikely to be a significant market as it’s the largest global producer of walnuts and no longer needs imports to fulfill demand. In the past five years, China has become a significant exporter, adding additional price pressure to the walnut industry.

Are there continued impacts?

Yes, tariffs, along with increased world production, increased competition, lower prices and non-tariff barriers continue to challenge the California walnut industry. Even with increased shipments to China and India, the impacts remain with these very high tariff rates as California’s walnut crop increases over the next few years.

Increased Tariffs Shift Market Focus for California Almonds

Five years ago, China was the second-largest export destination for California almonds. But the trade war’s increased tariffs helped shrink the Chinese market to No. 4 for the Golden State’s almond export shipments.

The decline stemmed from China’s trade-war decision to raise tariffs on U.S. almonds, lifting them from 10% to 55% beginning in 2018. As a result, the California almond industry felt its greatest trade-war impact with China.

But business with the Asian superpower has improved recently, said Julie Adams, vice president in Global Technical and Regulatory Affairs for the Almond Board of California.

“We’ve seen an increase in direct shipments to China, which is likely due to lower prices and more importers becoming familiar with the Chinese tariff exclusion process,” Adams said. “The exclusion brings the tariff down from 55% to 25%, which is still over double the previous 10% tariff in 2018. If you compare the volume and value of shipments to the region as a whole — China, Hong Kong and Vietnam – we are still behind former years.”

Yet there has been good news elsewhere. India was able to absorb much of that volume – and continues to be the leading export market for almonds.

“Almonds are shipped to more than 100 countries,” added Adams. “So, more than anything, we saw a shift in market focus. This diversified marketing portfolio across a variety of countries worldwide helps the almond industry adjust when marketing challenges arise.”

While the Biden Administration has been focused on COVID and a U.S. economic recovery, Adams expects trade to get more attention in the coming months. “We look forward to seeing increased progress on trade agreements with some of our key partners, particularly the E.U. and U.K.,” she said.