Global walnut production and exports will set records during 2020-21, impacting the export-reliant U.S. market. U.S. production is at record levels, but will likely remain in check due to a lack of price incentives. U.S. exports will likely continue to grow in the next five marketing seasons, but the challenge of boosting domestic demand will continue. Hence, it will be necessary to maintain high-quality product, research, innovation and marketing to enable the U.S. walnut industry to continue surmounting both international competition in the walnut market and increased competition in the tree nut space overall.

Market Trends in a Nutshell

Global walnut production is estimated to set a new record of almost 2.3 million metric tons (inshell basis) during the 2020-21 marketing year. This production level represents a 7% increase year over year and roughly 5% growth compared to the previous production record in 2016-17. More than 80% of 2020-21 global walnut production will come from three countries: China, the U.S. and Chile, with shares of 45%, 31% and 7%, respectively. Production out of the U.S. and Chile is estimated to be up about 20% year over year, setting new records, while production in China has recovered after a 15% drop in 2018-19.

Higher global production will build increased international competition in the export market. Global walnut exports are projected to grow about 14% year over year during 2020-21, with exports out of the U.S. expected to grow about 18% year over year and exports from Chile growing roughly 25% year over year. The U.S. and Chile were the largest walnut exporters during the last few years. However, the fast growth of exports from China, which is rapidly capturing market share, has been disruptive to the market and has surprised many industry participants. China is now competing for second place as a walnut-exporting country. International trade is critical for the U.S. walnut industry, as around 70% of U.S. production has been exported in recent years. Imports have not played a relevant role in the U.S. market over the last few marketing seasons.

Are More Bumper Crops Looming?

At Rabobank, we have developed a proprietary analytical tool to estimate U.S. production, U.S. shipments and U.S. average grower prices, taking into consideration relevant underlying variables. On the production side, our estimates are a function of bearing acreage and yields, which are functions of planted acreage and age of trees. Yield variability (weather risk) is captured aby the probabilistic nature of the model.

Estimated bearing acreage in 2020-21 increased by 4.1%, the lowest growth rate in the last five seasons. According to official figures, since 2016-17, newly planted acreage has been considerably lower compared to the levels observed during the decade before that. We expect that, on average, bearing acreage may grow at modest rates during the next five crop years. It is also likely that current low prices create enough incentive to even reduce bearing acreage, particularly of lower-value varieties, in some areas in years to come.

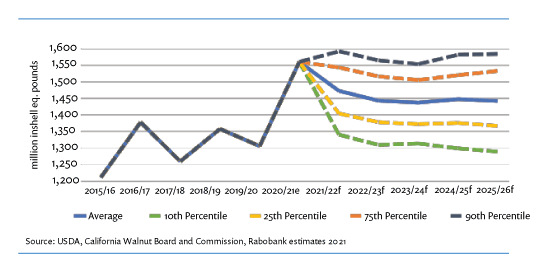

The 2020-21 U.S. walnut crop was, per the USDA objective measurement report, estimated at 1.56 billion pounds (780,000 short tons), a record crop up 19% year over year. The final crop number was slightly higher than that. Yields in 2020-21 were exceptionally high. For our production prospects, we use a yield probability distribution based on historical values. Our expected production levels show more average yields going forward. However, having average yields in every year is highly unlikely. Higher percentiles included in our production estimates show the likely ranges should higher yields be achieved. Hence, it is possible that we will observe a new record crop in the next few years.

A range of walnut production estimates are provided for the period spanning from 2021-22 to 2025-26 marketing years (Figure 1). Overall, estimates show that annual U.S. walnut production is likely to remain at higher levels than the 2019-20 crop size during the aforementioned period. On the other hand, the estimated probability of obtaining annual production higher than the current record crop during any specific year is about 10% (90th percentile).

Our average production estimate for 2021-22 is 1.47 billion pounds, roughly a 6% drop with respect to the record-setting crop in 2020-21. We calculate a 50% probability that production in 2021-22 will be between 1.4 billion pounds and 1.54 billion pounds. Our estimates show about a 90% probability that production will be roughly 1.34 billion pounds or higher (10th percentile) this coming season. The average U.S. walnut production estimate for the period 2021-22 to 2025-26 is around 1.45 billion pounds, roughly 11% higher than the observed production level during the 2019-20 marketing year. Percentiles show likely walnut production outputs depending on yield and acreage dynamics.

Downside Price Risk May Linger

While U.S. walnut shipments are keeping pace in the current season and we are projecting a growth in shipments in the longer run, the relevant question remains: at what price?

In our estimates, the E.U. remains the top destination for U.S. walnut exports over the next several years. Keep in mind that global demand growth is expected to continue, but lower prices are partially fueling this trend of growing shipments.

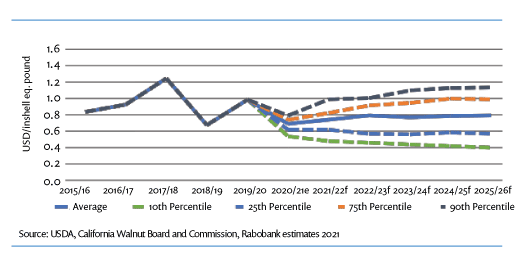

The expected average blended price to the grower for the 2021-22 to 2025-26 period is around USD 0.78 per inshell pound (Figure 2). As an example of how to interpret these price estimates, for the 2022-23 marketing year, there is a probability of 50% that the average (blended) price will be between USD 0.57 and USD 0.91 per pound (25th and 75th percentiles). Also, the estimated probability of observing prices north of USD 1.00 is about 25% for the 2024-25 marketing year and forward. Given a combination of higher demand and/or lower production (i.e., yield shocks), prices would sit at the higher range of estimated percentiles. These are average annual price estimates, so prices for specific varieties, handlers and regions would differ.

Is Walnut Demand Growing Fast Enough?

On a global level, walnuts have been the most widely consumed tree nut. However, during the last decade, the consumption growth of almonds and pistachios has outpaced that of walnuts, both globally and in the U.S. The growing popularity of tree nuts is a positive factor for the category as a whole, but it has not necessarily resulted in increased walnut consumption in the same proportion as in competing tree nuts, as consumers seem willing to spend only so many dollars in the category. Particularly in the U.S. market, the per capita consumption for the main tree nuts shows differentiated trends over the last two decades. While per capita consumption of walnuts in the U.S. has grown about 30% in the last 20 years, the consumption of almonds has grown almost 200% and pistachios more than 150%.

Research and Marketing Are Key

On the supply side, growers will continue to face increasing environmental and water regulations, which contribute to increasing production costs. Continued production of high-quality walnuts under more efficient production systems will remain imperative, and the industry has shown that it is possible to achieve that. Nevertheless, boosting demand in domestic and export markets for the growing U.S. output amid increased international competition is yet another formidable challenge.

Walnuts have a high protein content as well as an elevated level of healthy fatty acids. Although a versatile tree nut that can be used as for cooking, baking or snacking; many consumers consider walnuts to be primarily an ingredient. Industry reports show that the perception of walnuts in terms of convenience and value has improved over the last few years. According to a USDA report, consumers in some markets, “are increasingly purchasing walnuts all year round due to their perceived nutritional benefits. These healthy snacking trends are expected to continue driving consumption. The ongoing release of scientific studies and research highlighting cardiovascular benefits has made walnuts very popular among health-conscious consumers.” Continuing research on health and identifying new and innovative ways to use walnuts seems imperative. Also, finding ways to increase consumer demand for walnuts as a healthy snack is an ongoing challenge for the industry.

Since the start of the COVID-19 pandemic, higher demand for walnuts at retail due to increased baking and cooking at home may have partially compensated for the loss in the foodservice channel. A couple of trends may positively impact walnut demand going forward: 1.) continued remote working and home baking; and 2.) an increase in plant-based diets, which is likely a more permanent demand shift.

Creating global and domestic strategic partnerships with manufacturers to include more walnuts in different foods and snacks will be increasingly relevant to ensure U.S. walnut marketers find a home for their product. Consumer food companies and product manufacturers can take advantage of plant-based diet trends by promoting the healthfulness of walnuts and including (more) walnuts in their products. In the upstream value chain, the fact that walnut prices may remain close to the breakeven level for some growers could drive increased consolidation and vertical integration.