Janie Gatzman and Mike Ming know better than most about the value of California farmland.

Gatzman is not only a fourth-generation farmer who grows and processes almonds in the northern San Joaquin Valley, near Oakdale; she’s also owner of Gatzman Appraisal and a long-time accredited rural appraiser who specializes in valuing larger nut crop holdings as well as leaseholds all over the Central Valley.

Further, Gatzman is a member of the California Chapter of the American Society of Farm Managers and Rural Appraisers (ASFMRA). For the past eight years, she’s co-edited the group’s “Trends in Agricultural Land and Lease Values®” for California and Nevada, a respected report published annually. The 2021 edition was released in late March.

Ming, owner of Alliance Ag Services in Bakersfield, has more than 30 years of agricultural brokerage and appraisal experience in Kern County, one of California’s top almond and pistachio producers. He’s an accredited rural appraiser and a professional real estate broker. He’s also a member of ASFMRA and contributed to its 2021 Trends publication.

From their vantage points, Gatzman and Ming are seeing a substantial amount of buying, selling and even leasing interest in California’s tree nut land. Here’s what they’re reporting:

Investors are buying California’s larger tree nut properties.

Institutional groups like insurance companies (think Hancock and Prudential), real estate investment trusts, private equity firms and out-of-state teachers’ unions are making farmland purchases to diversify their portfolios. Their agricultural investments underscore their confidence in California’s long-term land market and their belief that farming can offer higher, more stable returns than the stock market. “We’re also seeing buying interest from large family operations looking to expand,” Ming said.

Property sellers tend to be larger farmers who are getting out of the business.

“Maybe they’re in partnerships that are falling apart or the next generation isn’t interested in continuing to farm,” Gatzman said. “Or they’re trying to consolidate their operations into better water areas or want to get rid of property that needs redevelopment, such as old orchards.”

Water is key.

“The water issue is huge,” said Ming, who has developed expertise in the Sustainable Groundwater Management Act (SGMA). The 2014 legislation provides a framework for long-term sustainable groundwater management across California. Many expect SGMA to result in hundreds of thousands of acres of farmland being fallowed due to groundwater pumping restrictions.

As a result, access to water supplies has become a major component of the state’s farmland values. Buyers are increasingly drawn to property with secure water rights. The highest valued land has “two-source water,” that is, viable groundwater and surface water supplies. Yet, Ming said, “in many areas, especially in the southern SJV, farmland with two-source water that’s available for sale is nonexistent.”

Some areas have plummeted in value because of SGMA-related groundwater restrictions. In some “white land” areas – land with no surface water supplies – per-acre values have dropped to less than $9,000, Gatzman said.

In Kern County, “demand for almond acreage is above average in well-watered districts,” Ming noted. Those orchards were valued at about $30,000 per acre during the first quarter of 2021. But almond property with poor water access is worth much less at about $15,000 per acre.

Pistachio orchards are outpacing other tree nuts in buyer interest, especially in the southern SJV.

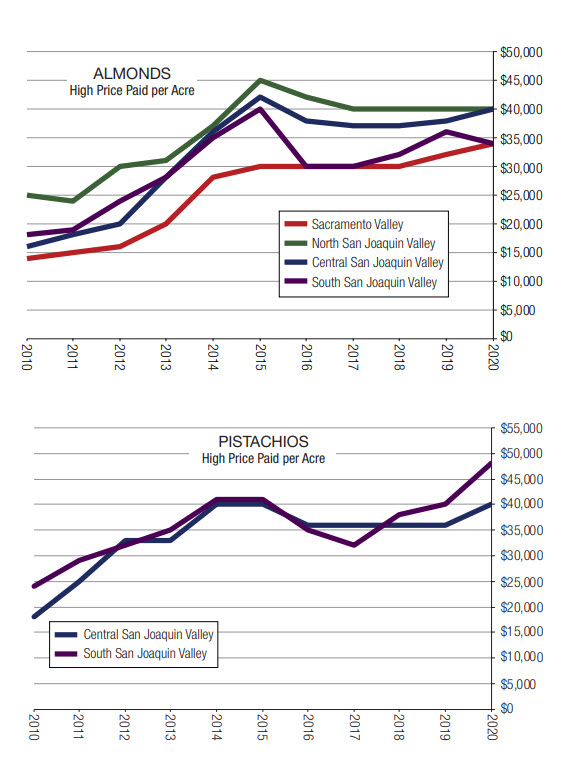

While almond and walnut orchard values have remained stable, prices for pistachio tree property have soared. Commodity prices for the crop remained well above the cost of production in 2020, making pistachios a “rare bright spot” among Western tree nuts, Gatzman noted.

Also bolstering pistachio land values? Because pistachio trees require less water than almonds or walnuts and can withstand lower-quality water and soils, “buyers have found these orchards are a good long-term bet in areas where both surface and groundwater supplies are decreasing due to regulation,” said Gatzman.

But that demand has sharply tightened the supply of pistachio orchards for sale in Kern County. Rising land values reflect that lack of pistachio availability.

“We have buyers writing offers at $55,000+ an acre depending on water access and orchard age,” said Ming.

Sales activity for walnut property has remained stable.

2020’s drop in walnut prices also put downward pressure on the crop’s land values. According to the 2021 Trends report, sales of Tulare County walnut properties were very limited, ranging from $24,000 to $30,000 per acre last year. In the Sacramento Valley, demand for good-quality walnut orchards remains strong, with significant demand coming from outside individual and group investors as well as large private equity groups. A limited number of walnut orchard transactions took place in 2020, with several high-quality orchards selling between $30,000 and $35,000 per acre. Older or lower-quality orchards are generally valued at $20,000 to $27,000 an acre.

Leasing tree-nut property is an option.

Although leasing tree-nut property is rare in the central and southern San Joaquin Valley, it’s common in the valley’s northern production areas, Gatzman said. In fact, she and her husband, Nick Gatzman, have long-term almond development leases totaling 180 acres on various properties in Stanislaus County.

“Farmland and orchards in our area can be prohibitively expensive for younger farmers like us to purchase outright,” said Gatzman, who began her career with Farm Credit. “I know many local farmers who lease tree nut properties, especially 20- to 40-acre parcels with high land values. There’s a lot of competition for new orchard development leases. A landowner interested in leasing his or her property typically can solicit multiple lease offers in our area.”

Whether land values rise or fall, California farmland remains an enduring asset. “Investors know that food production is always in demand, and California grows many commodities that can’t be produced anywhere else,” Gatzman said. “For family farmers, land represents opportunity they want to see continued for their children and grandchildren.

“For me, farmland value is also about history,” she added. “My great-grandfather farmed some of the property I’m farming today, and that means something.”

The complete 2021 Trends in Agricultural Land and Lease Values report is available for purchase at www.calasfmra.com.

If You Do Decide to Sell

As a certified public accountant and principal with Grimbleby Coleman CPAs in Modesto, Calif., Jeff Bowman has worked closely with tree nut clients for 20 years.

These days, he’s seeing long-time farming families looking to retire or transition out of the ag business. Like others, Bowman is also seeing growing interest in farmland from investment and non-farming groups. He even has some new clients who are first-generation farmers with resources from another industry looking to diversify into walnut and almond properties.

“If you own tree nut property and are thinking about selling, you might want to consider other options besides simply selling outright and taking the cash,” Bowman said.

A straight cash sale, for example, would likely require you to pay capital gains taxes, since your property will probably have risen in value since you acquired it. One option to minimize your tax obligation is carrying the note and taking the purchase payments in installments over a period of time.

“You would be spreading the taxable income over multiple years, which may help avoid a higher tax bracket,” said Bowman. “You might also incur other losses or deductions over that period to offset that income.”

Another option if you’re selling property is to take advantage of the Section 1031 tax-deferred exchange. In that case, you could invest the cash from the sale of your orchard into investment or commercial property, such as an office building. Your newly purchased exchange property can even be located out of state. The 1031 transaction doesn’t mean the sale of your orchard is tax-free. Instead, the tax you would have paid on the land sale is simply delayed until you sell the 1031 investment property.

“That can be a benefit, and it allows you to diversify your assets,” Bowman said.

Investing in “opportunity zones” to defer capital gains is another consideration. This federal economic development tool allows people to invest in distressed areas of the nation. By substantially improving or developing property in an opportunity zone, you can reduce or defer your capital gains if the investment is structured correctly and held long-term.

“We have clients who found land in an opportunity zone that could be farmed,” said Bowman. “They took undeveloped land and developed it into an orchard that was then attractive to other investors.”

If you decide to sell your land, work with someone from the appraisal or ag real-estate sector to make sure you’re getting a fair offer, Bowman said. In fact, it would be wise to include a team of experts, he added. For example, a realtor or broker with ag expertise can help market your property. A good business attorney can help structure a lease or installment sale.

“And definitely use a CPA, unless you enjoy tax surprises,” Bowman said.