The start of a new year marks the launch of new goals and resolutions for many, but it also means new regulations have begun to take effect. Beginning in 2022, there are several new laws agricultural employers need to pay close attention to and implement into their businesses.

California Wage Increase

In 2016, Governor Jerry Brown signed legislation that would gradually increase minimum wage rates over the period of seven years in California, with the intent that by 2023, all California employees would earn at least $15 per hour. January 1, 2022 marks the sixth year of this increase. California’s minimum wage reached the $15-per-hour threshold for large employers (those who employ 26 or more employees) and $14 per hour for small employers (those with less than 25 or less employees). Small employers will reach $15 per hour minimum in 2023. However, this is not the end of the increase. Beginning in 2023, large employers and, in 2024, small employers, will need to add a 3% cost of living increase to the minimum wage annually. In 2023, the minimum wage for large employers will be $15.45 per hour. Additionally, pay close attention to your local ordinances as some have imposed minimum wage rates higher than the state. For example, the cities of Sonoma, Santa Rosa and Petaluma have minimum wage rates currently higher than $15 per hour for large employers, and as an employer in those communities, you would be required to pay those higher rates.

In addition to increasing minimum wage, this legislation also created a parallel wage increase for overtime-exempt employees. The law requires exempt employees to earn twice the minimum wage rate. For instance, in 2022. large employers are required to compensate exempt employees at no less than $30 per hour with a 40-hour workweek with an annual salary of $62,400. And just like the minimum wage requirement, a 3% yearly increase will need to be enacted after reaching the $30-an-hour rate. For additional questions on these wage increases, please visit the State of California’s Department of Industrial Relations FAQ’s at dir.ca.gov/dlse/sb3_faq.htm.

Overtime for Agricultural Workers

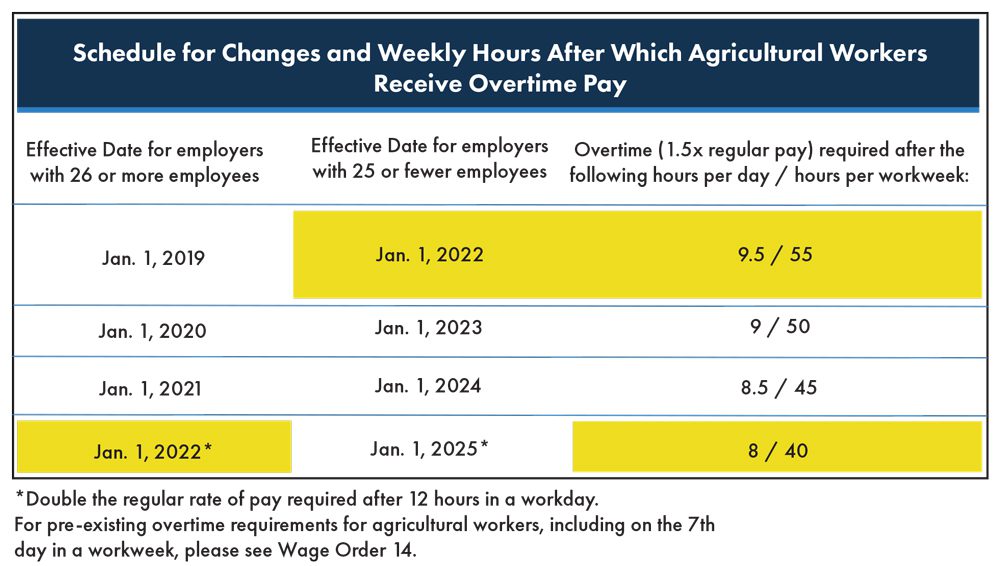

In 2016, the California legislature also passed Assembly Bill 1066, which created a gradual timetable for agricultural workers as defined by Wage Order 14, to receive overtime pay like those in other industries. In January 2022, large employers (those with more than 26 employees), and in January 2025, small employers (those with 25 or less employee), will be required to pay overtime to workers once they work more than an eight-hour day or more than 40 hours in a work week. AB 1066, now in its fourth year of implementation, requires large employers to pay overtime at 1.5 times the regular rate of pay if an employee works more than eight hours in a day or more than 40 hours in a work week. Beginning this year, small employers will need to begin complying with this regulation and pay overtime wages once a worker reaches more than 9.5 hours in a day or 55 hours in a workweek.

Please note that overtime requirements on the seventh consecutive day of work in a workweek have not changed. Employers are mandated to pay overtime at time and one-half time for the first eight hours of work and double-time for all hours worked after 8 hours on the 7th consecutive day of work in a workweek. Please see the chart for an annual adjustment of regular pay for a workday and work week.

Employee Record Retention

SB 807, which falls under the jurisdiction of the California Department of Fair Employment Housing, requires employers to retain personnel records for four years. Personnel records include employment applications, hiring documentation, policy acknowledgements, disciplinary write-ups and end-of-employment paperwork. Additionally, if a claim is filed, including an administrative claim, lawsuit or arbitration, these personnel records need to be kept indefinitely.

Personal Protective Equipment (PPE) for Essential Workers

SB 275 will take effect in January 2023; however, it is important that employers begin establishing a plan in 2022. This law requires employers to have an inventory of PPEs to last at least 45 days in the event a state of emergency is declared. This would include items such as eye protection, face coverings and respirators. However, please note some PPEs have expiration dates, such as N95 respirators. As a result, be strategic when purchasing inventory and rotate out any expired PPEs.

California Family Rights Act: Parent-In-Law & Designated Persons

AB 1033 modifies the California Family Rights Act to add additional individuals an eligible employee may take time off to care for. This amendment allows for employees to care for a parent-in-law as well as a designed person of their choosing (does not need to be a relative) at the time the employee requests leave. However, there is a parameter on a designated individual as an employee can only chose one non-family member in a 12-month period.

As you are gearing up for your 2022 season and find yourself in need of assistance implementing these new wage hour regulations or need to update your employee handbook, please feel free to contact the AgSafe team.

For more information about worker safety, human resources, labor relations and pesticide safety, please visit www.agsafe.org, call (209) 526-4400 or email safeinfo@agsafe.org. Information for this article was sourced through Charley M. Stoll, a Professional Corporation, Employment Bulletin, New Laws for 2022, January 2022.