Several companies have begun offering remote sensing paired with artificial intelligence analysis to improve the accuracy and efficiency of crop insurance underwriting and disaster assessment.

Aerobotics has begun selling precision multiple peril crop insurance through its agency, Aerobotics Crop Insurance Services, while Ceres Imaging has begun licensing data to insurers and lenders to use for underwriting and estimating disaster damage.

‘Precision’ Crop Insurance

Founded in 2014, Aerobotics uses artificial intelligence to analyze drone imagery, automatically identifying the number of trees per farm and providing performance metrics for each tree.

“Really, what we’re trying to do is find problem areas within the orchard by assessing each individual tree and direct the grower to those areas to rectify the problem,” said Andrew Burdock, chief insurance officer at Aerobotics.

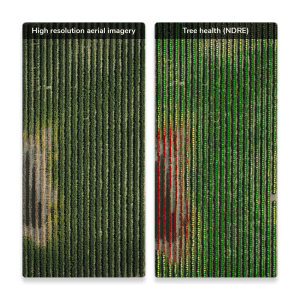

The company has established a network of partner drone pilots throughout the nation that image fields and orchards. While the pilots may use various drone makes and models, they all use a standardized digital imaging camera fitted with multispectral and thermal imaging filters. The filters block specific light wavelengths, allowing the camera to capture other reflected light wavelengths that may be indicative of plant health, for example.

About four to five years ago, Burdock said he was contacted by a Florida insurance company about using their technology to help with in-field crop inspections by adjusters. The request seemed like a natural fit as Aerobotics was already helping citrus growers assess tree health and tree losses caused by the bacterial disease citrus greening, also known as huanglongbing or HLB.

Aerobotics spent more than three years inspecting farms for insurance companies before setting up its own precision crop insurance agency. Aerobotics Crop Insurance Services uses its data to prepare the policies for its growers’ sign-off before submitting them to authorized crop insurance companies that underwrite them.

“We can identify the trees per acre, tree age and the spacing to make sure what’s on the insurance policy matches exactly what’s on the ground,” he said. “That replaces a lot of the manual inspection work and made the crop insurance adjusters much more efficient.”

Insure Only Producing Acres

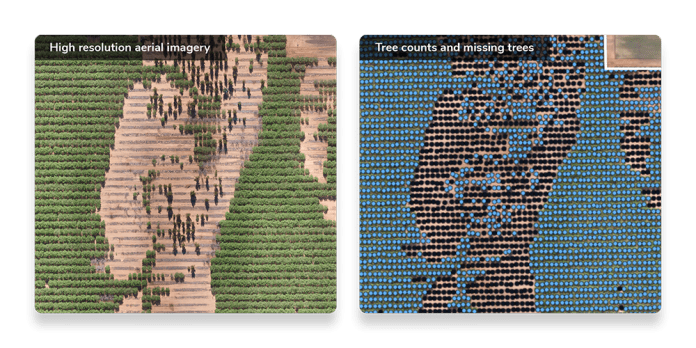

Included with each crop insurance policy is a full-farm drone flight and analysis of the data. Not only can the technology provide accurate overall acreage figures, but it also can calculate producing acres, which considers missing or non-bearing trees, he said.

“It’s super important for a grower to get a policy correct with the production per acre, tree counts and missing trees,” Burdock said. “If you have 100 acres, once you start taking out missing trees or smaller trees, it can take you down to 90 or 80 [producing] acres quite quickly. If there’s a claim, you can run into some trouble if your numbers declared on the policy were incorrect.”

With traditional crop insurance, non-producing acres are often included in the coverage, and growers are responsible for providing accurate estimates of insurable acres. In the event of a claim, inaccurate information could put the grower at risk of loss adjustments or, worse yet, a claim rejection.

Aerobotics uses high-resolution imagery and artificial intelligence to distinguish between producing and non-producing trees on an individual tree-level that results in an accurate percent stand. This translates into accurate policies where the grower only pays premiums on producing acres.

By also analyzing tree health, which includes the tree canopy area, Burdock said Aerobotics can help growers decide the level of crop insurance coverage they should purchase. “I think it’s pretty interesting that as we work for two, three and four years with our growers, we can see how the blocks are trending and what coverage levels they should be selecting,” he said.

This year, Burdock said it will be even more important to identify missing trees blown over during the storms or damaged because of prolonged standing water.

“I think this year in particular with the rain and damage, a lot of guys are going to want to know how many acres they’re going to need to insure,” he said.

Helping Streamline Insurance Claims

Ceres Imaging has taken a slightly different approach. Using satellite imagery and a fleet of manned aircraft with high-resolution sensors, the Oakland-based company can provide customers critical information on crop conditions throughout the growing season, said Corey Feduck, director of business development.

The planes can cover up to 10,000 acres a day and be directed to specific areas as needed. Typically, the company can process imagery and crop analytics within 24 to 48 hours and can turn around an accurate damage assessment in about 72 hours.

Ceres uses algorithms that separate soil and other vegetation from the primary crop to identify crop health components, including tree or plant vigor, chlorosis and water stress, he said. The Ceres multispectral sensor array includes a thermal sensor to identify areas of the orchard or field showing early signs of poor crop health, water stress or irrigation system issues.

“It’s very important to deliver insights and data, not just imagery,” Feduck said.

In addition, the company’s high-resolution sensor array allows it to conduct a complete census of every tree or vine instead of using a sampling method or estimate.

“We can report that, for example, 58%, or 987 almond trees, have decreased in crop health following a severe weather event, 24% experienced moderate damage and 18% are unaffected,” he said.

This information can help growers complete their annual crop insurance forms with their agents, saving time and possible misreporting. Some growers have also started using the data to estimate crop damage to support insurance claims.

“This year, Ceres Imaging flew some of the flooded areas in California to support the grower with data on how many trees are within a flooded area,” Feduck said.

In addition, the reports can help growers decide whether to report a claim, and they can be provided to crop insurance adjusters for a quick, accurate appraisal, he said.

Feduck said the company does not plan to offer insurance products but instead is working to help customers streamline their interactions with agents and loss adjusters.

Feduck said Ceres has taken steps to ensure that data is collected and stored securely.

Vicky Boyd | Contributing Writer

A veteran agricultural journalist, Vicky Boyd has covered the industry in California, Florida, Texas, Colorado, the South and the Mid-South. Along the way, she has won several writing awards. Boyd attended Colorado State University, where she earned a technical journalism degree with minors in agriculture and natural resources. Boyd is known for taking complex technical or scientific material and translating it so readers can use it on their farms. Her favorite topics are entomology, weeds and new technology. When she’s not out “playing in the dirt,” as she calls agricultural reporting, Boyd enjoys running, hiking, knitting and sewing.