Faced with decreased sales and lingering inflationary costs the past marketing year, Blue Diamond Growers leaders took a deep look inward and developed a new strategic plan to guide the almond co-op.

“The challenges we face are the same as growers face,” said Blue Diamond President and CEO Kai Bockmann as he addressed about 1,200 growers attending the recent annual meeting in Modesto. “Costs, significant weather events and depressed market prices have created the perfect storm. What helped us get to where we are today isn’t necessarily going to help us in the future.”

Calling the plan “ambitious,” he said it comprises five pillars designed to strengthen growth of consumer products, accelerate international marketing efforts, build the relatively untapped food service sector, continue to innovate and increase efficiency internally.

In the 12 months since Bockmann was hired to lead Blue Diamond, he traveled the state and met with grower-members to hear their concerns. He and the executive committee also tapped experts in consumer-packaged goods, food service, and international product development and sales to help develop the strategic plan.

“It’s more than just volume; it’s about driving growth and returns to our growers,” Bockmann said.

For the marketing year ending Aug. 25, 2023, Blue Diamond had net sales of about $1.33 billion compared to $1.6 billion for 2022. Grower returns for 2022 crop-year Nonpareil and Supareil meats averaged $1.65 per pound, maxing out at $1.74 including quality premiums. A year earlier, 2021 crop-year Nonpareil and Supareil meats averaged $2.20 per pound, with $2.30 per pound including premiums.

Returns for Independence, Carmel, Butte, Padre, Monterey, California, Fritz, Price and Wood Colony for the 2022 crop year averaged between $1.38 to $1.40 per meat pound, topping out at $1.44 per pound with quality payments. Compare that to $1.86 to $1.90 per meat pound average for those varieties for the 2021 crop year, maxing out between $1.90 to $1.95 per meat pound with quality incentives.

Bockmann attributed much of the drop in returns to an industrywide oversupply. The state’s almond industry began the 2023-24 marketing year with roughly an 800-million-pound carry-in. A more desirable carryover is between 300 million and 400 million pounds.

Several Blue Diamond growers attending the annual meeting described the current economic situation as “bad” as production costs exceeded returns the past few seasons. During the 2022 growing season, an April freeze, reduced irrigation supplies in many counties and a late summer hot spell exacerbated the situation.

Although winter and spring rains brought much-needed drought relief to 2023, they also delayed everything from bloom to hull split to harvest. The 2023 season also was marked by historically high reject levels caused mainly by navel orangeworm.

Plans to Build Consumer Growth

Within the consumer segment, Blue Diamond continued to lead both the non-dairy milk and snack nut categories despite a challenging marketing environment. Inflationary pressures were felt by consumers, many of whom shifted their buying habits and either traded down to smaller package sizes of snack nuts or stopped buying almonds altogether.

Even with a decrease in overall almond snack consumption, Blue Diamond grew its market share of the almond segment by 2.5 points for the marketing year ending Aug. 25.

Almond Breeze increased its lead over rival Silk as the No. 1 selling branded almond milk. Within the competitive non-dairy milk segment, Almond Breeze gained 0.8 points of market share while within the almond milk segment it gained 2.3 points.

Raj Joshi, Blue Diamond chief growth officer, said the co-op plans to build on the momentum in those two segments as part of its strategic efforts.

“It’s important to bring new people into our brand but equally important is keeping them with the brand,” he said.

To do that, Blue Diamond continues to lean heavily on its innovation center opened in 2013 in Sacramento. At the time, it was billed as the only developing and testing center focused entirely on bringing new almond products to market.

Two of the more recent launches are Korean BBQ and elote Mexican street corn-flavored snack almonds. Chilé ‘n Lime, which was a limited-edition release, has joined the regular offerings. In fact, People magazine’s Food Awards 2023 named the flavor “best nuts.”

Blue Diamond recently introduced Thin Dipped Almonds with limited distribution at its grower stores and Walmart. Beginning in 2024, the co-op plans nationwide distribution of the two sweet flavors.

Yet despite market-leading standings, less than 20% of U.S. consumers buy Blue Diamond almonds, Bockmann said.

“It’s surprising that eight out of 10 houses in the U.S. do not have our product,” he said.

To that end, the co-op has already begun delivering what it believes are compelling messages with its “Gimme Me Blue Diamond” and “Almond Milk It” advertising campaigns.

A relatively untapped opportunity for almonds is food service, a $1 trillion-plus market that covers any meal eaten outside the home, Bockmann said. Among potential uses for almonds are as baked good ingredients, in ethnic dishes and as salad toppers.

International markets also are ripe for expansion, Bockmann said, noting the strategic approach the co-op plans to take.

Dean LaVallee, chief operating officer/chief financial officer who came onboard after 20 years in Canada with Kraft Foods, pointed to Canada as an example. The country has about 10% of the U.S. population. Using that as a rule of thumb, he said Blue Diamond should sell about 7 million pounds annually in Canadian markets. Yet the co-op sells less than 1 million pounds, which DeVallee said it needs to grow. Among the bright points is a cult-like following of its spicy dill pickle almonds by Canadian Costco shoppers.

“It will take time to build it, but Canada has shown a love for almonds,” he said.

Among other successes on the international side, Blue Diamond introduced an almond-based cooking cream in Brazil and vitamin- and mineral-fortified almonds in South Korea.

Expanding Sustainability Efforts

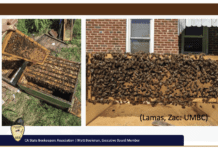

Since its launch in 2018, Blue Diamond’s Orchard Sustainability Incentive Program has provided financial incentives to members who participate in the Almond Board’s California Almond Sustainability Program. Blue Diamond growers can earn additional premiums if they become Bee Friendly certified and complete a carbon footprint assessment to reach the triple diamond level. Those in the top tier receive a base payment of $1,000 plus 1 cent per pound.

In 2022, the last year for which figures are available, the co-op paid $1.74 million in OSIP incentives.

The program has already begun to resonate with customers, particularly those in the European Union where sustainability is a critical part of food production.

Thanks to a five-year $45 million USDA Partnerships for Climate-Smart Commodities Grant awarded in early 2023, Blue Diamond expanded the financial support provided by OSIP.

Through a partnership with Project Aphis m., growers can receive free seeds and/or plant material for “conservation cover,” also known as pollinator habitat. In addition, they can receive direct grower payments to offset the cost of implementing cover cropping, conservation cover, hedgerows and whole orchard recycling.

During the first year, grower-members representing more than 10,000 acres of cover crops signed up, exceeding Blue Diamond’s goals for FY23.

New Grower Buying Group

Much like the rising costs the co-op’s processing side has faced, Bockmann said growers have experienced similar inflationary pressures. Since 2020, grower input costs have risen an average of 20%.

To address that, Blue Diamond has partnered with non-competing co-ops like Land O’Lakes and Ocean Spray Cranberries to create Grower Connect Market Place. The exclusive e-commerce website for goods and services lets users comparison shop and place and track orders. By leveraging the collective group’s buying power, Bockmann said the goal is to reduce member input costs.

Vicky Boyd | Contributing Writer

A veteran agricultural journalist, Vicky Boyd has covered the industry in California, Florida, Texas, Colorado, the South and the Mid-South. Along the way, she has won several writing awards. Boyd attended Colorado State University, where she earned a technical journalism degree with minors in agriculture and natural resources. Boyd is known for taking complex technical or scientific material and translating it so readers can use it on their farms. Her favorite topics are entomology, weeds and new technology. When she’s not out “playing in the dirt,” as she calls agricultural reporting, Boyd enjoys running, hiking, knitting and sewing.