The U.S. Department of Labor’s Wage and Hour Division recovered more than $273 million in back wages and damages nationwide in fiscal year 2024. And, as the top agricultural producing state in the country and the state with the highest number of employed people, it comes as no surprise California also leads the country in wage and hour claims. Within the state, the California Labor Commissioner’s Office collects tens of millions of dollars annually in wage and hour damages.

These cases are particularly appealing to plaintiffs’ attorneys, who focus on meal and rest break penalties, overtime pay and other technical violations. A statute of limitations that can extend up to four years, along with potential liquidated damages, and automatic recovery of plaintiffs’ attorneys fees can substantially increase damages beyond a simple backpay and/or missed meal premium owed.

Making wage and hour compliance an even higher-stakes proposition for employers, in California, under the The Private Attorneys General Act (PAGA), employees are authorized to act as a “private attorney general,” recovering civil penalties on behalf of other similarly situated (aggrieved) employees, for Labor Code violations. The number of claims filed, and the number of penalties awarded have been on the rise year-over-year, making it critical for employers to stay vigilant and proactive in their compliance efforts.

The start of the new year marks an ideal time to review the below meal and rest period requirements, regular and overtime pay requirements, often-overlooked required compensation and a reminder on the increased minimum wage that took effect Jan. 1, 2025. The beginning of the year is also the perfect time to review your company policies and processes to ensure these, along with your Handbook, are up to date.

Meal/Rest Periods

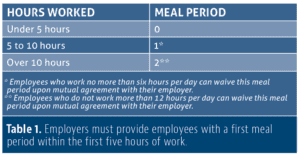

Employers must provide employees with a first meal period within the first five hours of work. Meal periods must be 1) uninterrupted; 2) at least 30 minutes in duration; and 3) off duty (unless valid on-duty agreement is in place). ‘Off duty’ means the employee is relieved of all duties and free to leave the premises.

Although an employer is not required to “police” employees to ensure meal periods are taken, an employer is required to make a compliant meal period available for employees. In addition, employers who become aware of significant deviations from the law have an affirmative obligation to comply with the requirements. Otherwise, an employer can be found to have ratified the non-compliant schedules.

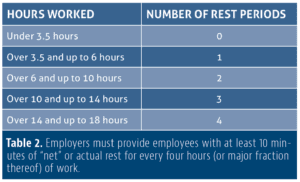

Employers also must provide employees with at least 10 minutes of “net” or actual rest for every four hours (or major fraction thereof) of work. Rest periods should be taken as far as practicable in the middle of each work period. Rest periods must be “authorized and permitted,” cannot be waived and must be paid. Employees must be fully off duty and able to leave the workplace.

Litigation pitfalls

Ask yourself these questions:

1. Off Duty: Was the meal/rest period actually off duty? Are employees free to leave during their meal/rest period? Are they expected (or required) to respond to radio messages or phone calls during meal/rest periods?

2. Diminishment: Did the employee receive their full and uninterrupted meal/rest period? Did they have to walk from the field or production line to a rest area?

3. Waivers: Does the employee have a signed meal waiver? Can the company show the employee voluntarily gave the waiver? Recall, employees cannot waive a rest period.

4. Piece Rate Workers: Is the company properly calculating and paying employees earning a piece rate for their non-productive rest time at the employee’s regular rate of pay?

Penalties and preventative measures

For each non-compliant meal or rest period, employers must pay the employee one additional hour of pay at the employee’s Regular Rate of Pay. This applies whether the employee skipped a meal or rest period as well as if the meal/rest period were untimely, interrupted or short. Employers must pay for every violation and therefore could have more than one meal/rest period penalty per day.

Non-compliance with meal and rest period regulations can lead to significant penalties, including additional compensation for each workday a period is missed. Employers should implement preventative measures, such as clear policies and disciplinary actions, to ensure adherence to these regulations.

Compliant meal and rest break rules

1. DO implement meal period and rest period policies.

2. DO NOT impede employees from taking meal/rest periods.

3. DO keep records of meal/rest periods.

4. DO use preventative measures such as a discipline policy for meal/rest break violations.

5. DO use meal waivers for shifts up to six hours, and for shifts over 10 hours.

6. DO pay meal/rest premiums upon discovery of every missed meal/rest period.

What Is a Regular Rate of Pay?

Regular Rate of Pay is the rate an employee is paid for their work and, importantly, is the rate used to calculate overtime and sick leave. However, calculating the Regular Rate of Pay is not straightforward and requires considering factors like whether employees are paid a non-discretionary bonus or a piece rate. Calculating the Regular Rate of Pay requires all earnings (except statutory exclusions) be divided by all hours worked.

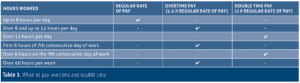

Overtime Rates

California overtime, like the Regular Rate of Pay, is not straightforward. Employers must consider, amongst other factors, whether the employee must be paid for daily overtime, double time, seventh day premiums and how salaries, bonuses and commission play into calculating this rate.

Other Considerations

When to pay off the clock time?

Employers should be on the lookout for “off the clock” activity. Off the clock activity could be time spent walking to fields, waiting times and prep work (such as donning and doffing PPE), for which employees should be compensated.

Employers must ensure employees are aware of their rights and should have clearly defined processes for employees to immediately report any time and/or compensation discrepancies.

When must you compensate for work-related expenses?

Under California Labor Code, employers must reimburse employees who are required to use their own tools or equipment or when use of their own tools and equipment is necessary for the employee’s performance of a job. Employers can require employees who earn at least two times the minimum wage to provide and maintain their own tools and equipment.

Employers should consider whether they need to reimburse employees for use of their cell phones. When, for example, employees use their cell phone to communicate with management while in the field, or to clock-in and clock-out. Another overlooked expense that employers often must reimburse is mileage (e.g., when an employee drives their personal vehicle for work-related tasks or between work sites during their shift).

Are you paying the correct minimum wage?

Although California voters rejected Prop 32, which would have raised the minimum wage to $17 or $18 per hour (depending on the size of the employer), on Jan. 1, 2025, the state’s hourly minimum wage will increase to $16.50 (regardless of the size of the employer) based on the regular annual adjustment formula.

By understanding and addressing the aforementioned issues, employers can better ensure compliance while fostering a fair and productive work environment. For more detailed guidance, employers are encouraged to consult with legal experts and stay informed about the latest developments in labor law.