The U.S. walnut industry has faced significant challenges since the onset of tariff wars in 2018. These difficulties have been compounded by demand shifts to other tree nuts, increasing international competition and unsatisfactory new walnut varieties. Many growers have been discontent with farm-gate prices, and as revenues have remained below production costs in recent years, some are considering moving into alternative crops.

Walnut market news has largely focused on negative developments such as declining production, orchard removals and global market disruptions. Nevertheless, it is important to take a broader perspective of the international walnut market and analyze its long-term trends. While growers and industry stakeholders have been struggling to solve current issues, they need to assess future opportunities and emerging markets before making drastic decisions that could lead to potential losses and a diminished presence in the global walnut market.

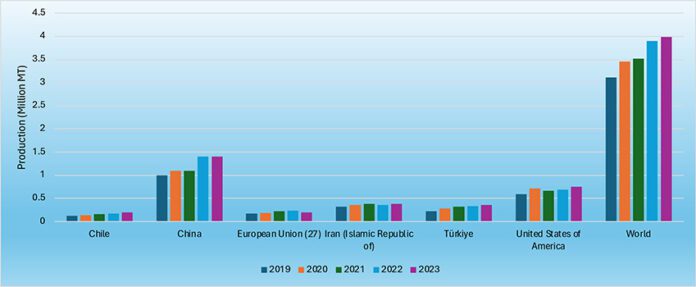

Global Production

China has been the largest walnut producer since the early 2000s (Fig. 1), while production in the United States, the second-largest producer, has increased gradually over the same period. Other major growing regions continue to expand production, which aligns with increasing walnut demand in recent years. Current trends also show that emerging producing regions are gaining traction with a shift in global market share.

Climate variability and disease pressures are the main factors influencing yield efficiency. The United States remains one of the most productive producers, with some of the highest yields due to advanced farming techniques. Technological advancements and improved genetics are expected to enhance yield further (Fig. 2).

Exports

The United States still dominates the global walnut export market; however, emerging exporters are increasing the competition. Global demand remains strong, but logistics and tariffs play a crucial role in trade flow (Fig. 3).

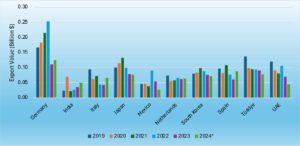

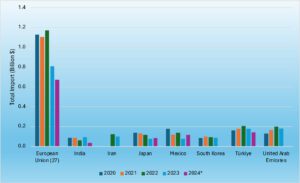

The major export destinations of U.S. production include the European Union, Middle East and Asian markets (Fig. 4). Trade agreements and tariffs will significantly affect U.S. export performance. Economic shocks in international markets not only affect walnut exporters but also increase commodity price risks and intensify global competition. To mitigate reliance on key markets, it is important to actively pursue diversification strategies for export destinations.

China exports mainly to Asian and Middle Eastern markets. Chinese domestic consumption is increasing, which may reduce export volume. In addition, trade tensions and quality concerns impact China’s competitiveness.

Major walnut importing countries are located in the European Union, Asia and the Middle East (Fig. 5). Demand is fueled by health-conscious consumers and the expansion of the food processing industry. Currency fluctuations and import regulations continue to shape these market forces.

Future Growth

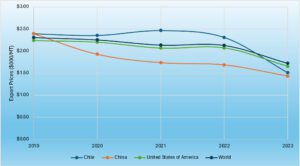

U.S. farm-gate prices have been volatile, driven by supply chain disruptions and rising production costs. Producer margins are further affected by the value of the U.S. dollar and labor expenses. Future pricing trends will hinge on global supply and demand dynamics. Free-on-board price fluctuations are largely shaped by production volumes and trade policies. Strong demand in key markets helps support price stability, while international competition continues to pressure profitability in the U.S. walnut industry (Fig. 6).

Changing market dynamics include increasing competition from new producing regions, shifts in consumer preferences toward sustainable walnut production and policy changes affecting tariffs and trade flows.

The U.S. market is projected to see sustained demand growth, driven especially by health-conscious consumers. Ongoing supply chain improvements have contributed to greater price stability and operational efficiency. There is also significant potential for increased mechanization in harvesting and processing.

Looking ahead, global production is expected to grow, especially in emerging regions that are increasingly focused on sustainability and environmental compliance. Continued investment in digital supply chain solutions, particularly in traceability and targeted marketing, is set to drive future innovation and competitiveness.

International market trends will be shaped by growing demand in Asia and the Middle East, driven by shifting dietary preferences. Premium-quality walnuts are expected to capture greater market share in high-income countries. However, rising anti-globalization sentiment suggests trade barriers and tariffs could disrupt demand patterns. While the United States and China continue to lead the industry, global competition is intensifying. Export performance and pricing remain sensitive to trade policies, climate conditions and evolving consumer behaviors. Future growth will depend on technological innovation, market diversification and a strong commitment to sustainability and regulatory compliance.