The California almond industry enters 2026 facing a blend of pressure and progress. Rising production costs, regulatory demands and shifting global markets continue to challenge growers, even as signs of recovery take hold and long-term investments in research and marketing show measurable results.

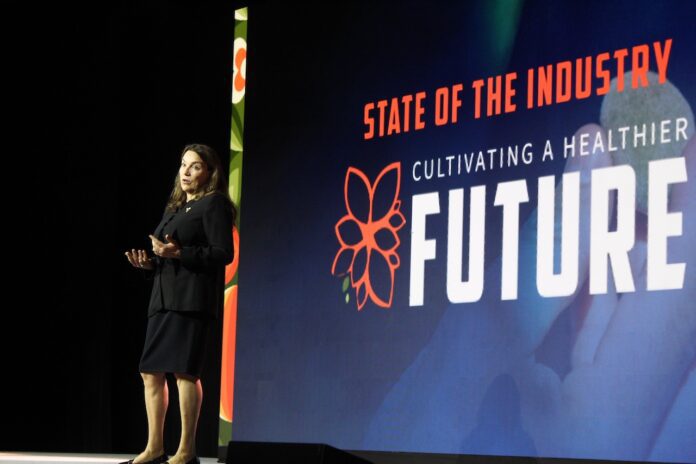

These themes were clear at The Almond Conference’s State of the Industry session last month, where President and CEO Clarice Turner acknowledged the difficulties growers are experiencing while also highlighting areas of momentum. Operating costs have risen between 27% and 40% in the last five years, she noted, and inflation, water pricing, inputs and compliance remain major hurdles. Growers in the audience nodded as she spoke, reflecting how widespread those pressures have become.

But Turner emphasized that resilience has long defined the industry. This year marks the 75th anniversary of the Federal Marketing Order that established the Almond Board of California (ABC), a collective framework growers overwhelmingly chose to reaffirm in last year’s referendum.

“While this presents several challenges for the California almond industry, we aren’t alone,” Turner said. “There remains a strong spirit of resilience.”

Demand Strength Holds as Markets Shift

Despite recent volatility, global demand continues to show strength. Almond shipments averaged 220 million pounds per month last crop year, making it the industry’s third-largest shipping year. Almonds also remain the top nut used in new product introductions worldwide, with more than 9,000 launches last year. Turner credited decades of nutrition research and strong manufacturer partnerships for helping sustain that momentum.

New scientific insights are also opening additional doors. A recent AI-enabled research collaboration identified 530 health-promoting compounds in almonds, more than four times previously documented. Turner said the finding strengthens ABC’s ability to communicate almond nutrition value to consumers, dietitians and health professionals.

Foodservice partnerships are also gaining traction. A 2025 pilot with Smoothie King led to almonds being added to more menu items even after the promotion ended.

“We changed behavior,” Turner said. “That is really important and sets us up for future partnerships.”

Global expansion remains a priority as well. After more than a decade of negotiations, almond shipments to Japan now face less than 4% random inspection, down from 100%. USDA grants totaling $13 million have accelerated work in Turkey, Morocco and other emerging markets.

“Persistence does pay off in trade,” Turner said.

Economic signals remain mixed. Economist Scott Clemons of Brown Brothers Harriman told attendees the U.S. economy has entered a slower phase marked by softening job growth, rising household stress and declining consumer sentiment. While spending remains stable, he said uncertainty around tariffs and policy direction is a significant concern for export-dependent industries such as almonds.

“Tariffs are probably just the top of a long list,” Clemons said.

Stabilizing Supply and Strengthening Advocacy

Costs and regulatory pressures remain top concerns for growers. Turner acknowledged that high production costs and competitive pressure from other plant-based ingredients pose daily challenges. ABC is expanding grower decision-support tools and sharpening marketing efficiency as global almond supply stabilizes.

As part of broader restructuring, Turner also announced that ABC will discontinue funding for USDA’s Objective Estimate beginning next year. The decision drew immediate applause in the room and signaled a shift in how the industry plans to approach data and forecasting.

Regulatory advocacy continues to play a major role in industry stability. Alexi Rodriguez, CEO of the Almond Alliance and former ABC chair, noted that nearly every factor affecting profitability is shaped by government policy. Because ABC cannot lobby, the Alliance relies on its research and technical data to communicate real-world impacts to lawmakers. She pointed to past tariff disputes and the national discussion around ultra processed food labeling as examples of how coordinated advocacy helps protect demand and grower returns.

Market indicators are beginning to turn upward. Board Chair Bob Silveira said grower returns improved from about $1.60 per pound in the 2023 crop to about $2.30 per pound for the 2024 crop, evidence that the industry is “coming out of it.” Supply has declined for five consecutive years, helping rebalance the market after a prolonged oversupply.

“It is not enough,” he said, “but it is moving in the right direction.”

As the session closed, Turner encouraged growers to remain engaged as ABC’s priorities evolve, emphasizing that their input through surveys, committee work and stewardship reporting directly shapes the organization’s direction. She said California almond growers continue to meet some of the highest standards in the world and that their stewardship and innovation remain central to the industry’s reputation.

“Working together, I truly believe we can shape a stronger future for all,” Turner said.

Kristin Platts | Digital Content Editor and Social Correspondence

Kristin Platts is a multimedia journalist and digital content writer with a B.A. in Creative Media from California State University, Stanislaus. She produces stories on California agriculture through video, podcasts, and digital articles, and provides in-depth reporting on tree nuts, pest management, and crop production for West Coast Nut magazine. Based in Modesto, California, Kristin is passionate about sharing field-driven insights and connecting growers with trusted information.