Listen to the audio version of this article. (Generated by A.I.)

The California almond industry enters 2026 facing a mix of challenges sprinkled with signs of recovery. Growers continue to grapple with rising production costs, regulatory pressure and shifting global demand, even as key markets stabilize and long-term investments in research and marketing begin to show results. Leaders across the sector say the coming year will require both resilience and strategic focus to protect grower returns.

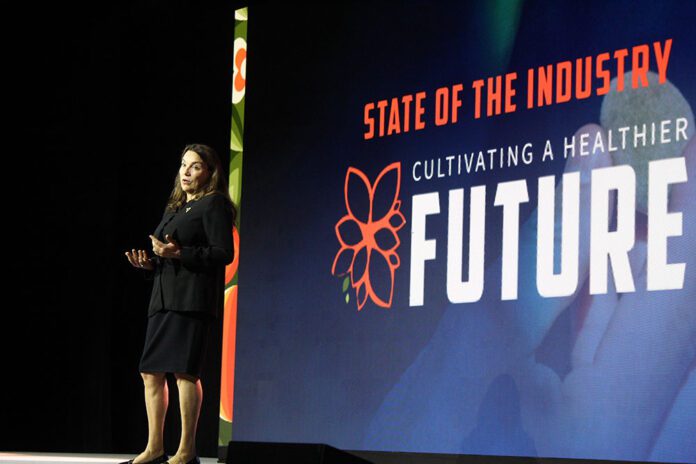

These themes were clear at The Almond Conference, where President and CEO Clarice Turner acknowledged the pressures growers are facing while highlighting areas of momentum. Turner noted that operating costs have risen sharply between 27% and 40% in the last five years, according to UC Davis, and that inflation, water pricing, input costs and compliance burdens continue to squeeze margins. That point landed with the room, where many growers nodded in quiet agreement.

“While this presents several challenges for the California almond industry, we aren’t alone,” Turner said during the conference’s State of the Industry session. “There remains a strong spirit of resilience.”

That same resilience has shaped the almond industry for decades. This year marks the 75th anniversary of the Federal Marketing Order, established in 1950 under President Harry S. Truman at the request of California almond farmers. Nearly every grower who voted in last year’s referendum supported continuing the order, a signal of broad alignment around the collective work that underpins marketing, research, technical programs and global reputation building.

Noting the industry’s longstanding commitment to unified action, Turner quoted an African proverb: “If you want to go fast, go alone. If you want to go far, go together.”

Demand Strengths and Market Opportunities

Despite recent volatility, there were signs of demand strength. Almond shipments averaged 220 million pounds per month last crop year, marking the industry’s third-largest shipping year, and they remain the top nut used in new product introductions worldwide, with more than 9,000 launches last year alone. Turner said these trends demonstrate the impact of decades of nutrition research and strong relationships with manufacturers.

New scientific findings are also opening additional avenues for outreach. A research partnership using AI-driven analysis identified 530 health-promoting compounds in almonds, more than four times previously documented. The discovery gives ABC new footing, Turner said, when communicating with consumers, dietitians and health professionals.

“This provides yet another platform to engage and educate about the unique benefits of California almonds,” she said.

ABC is also increasing its focus on foodservice and ingredient manufacturing. A pilot partnership with Smoothie King in 2025 resulted in almonds being added to more smoothies, both during and after the promotion.

“We changed behavior,” Turner said. “That is really important and sets us up for future partnerships.”

Global diversification remains essential as well, she noted. In Japan, after more than a decade of negotiations, almond shipments now face less than 4% random inspection, down from 100%. Additional USDA grants totaling $13 million have accelerated work in emerging markets including Turkey and Morocco.

“Persistence does pay off in trade,” Turner said.

Economic Signals and Trade Pressures

Scott Clemons, partner and chief investment strategist with Brown Brothers Harriman, returned to the conference to provide an economic update as the industry looks toward 2026. Speaking virtually, he said the U.S. economy has entered a slow patch marked by softening job growth, declining consumer sentiment and rising household financial stress.

“The labor market is not in reverse,” Clemons said. “We are simply not adding jobs at the same pace we have over the past several years.”

Clemons outlined three factors shaping the economic mood. Nearly three quarters of Americans expect unemployment to rise, surveys show that consumers believe inflation will remain elevated, and delinquencies on credit cards and auto loans are increasing. While consumer spending is still strong, he cautioned that confidence could weaken if these pressures continue. He also noted that uncertainties surrounding tariffs and trade policy remain top of mind for industries reliant on global markets.

“Tariffs are probably just the top of a long list,” he said. “That uncertainty is not going away.”

Even so, Clemons emphasized the historical resilience of both the broader economy and the agricultural sector.

“I continue to be impressed by the resilience of small businesses making the decisions they need to make despite uncertainty,” he said.

Costs, Competition and Regulation

Noting the overwhelming cost of production, Turner said she recognized that growers continue to face intense pressure from price volatility, export dependency and rising competition from other plant-based ingredients.

“It is not just a challenge. It is a daily struggle for every grower,” she said.

ABC is responding by expanding grower decision-support tools introduced at the conference and by sharpening its focus on marketing efficiency. Global almond supply is expected to remain stable to slightly declining through 2030, which will help rebalance markets after years of oversupply.

Trade stability also remains a priority, and Turner called the decade-long effort to reform Japan’s inspection protocol evidence of the value of persistence and technical expertise.

“Trade officials around the world repeatedly tell me that the Almond Board has a reputation for providing strong data and offering creative solutions,” Turner said.

As part of adapting to shifting market conditions, Turner also announced that ABC will discontinue funding for USDA’s Objective Estimate beginning next year, a significant change after decades of reliance on the report. The moment drew immediate applause across the room, underlining how consequential the decision felt for growers already recalibrating to market volatility and tightening margins.

Alexi Rodriguez, CEO of the Almond Alliance and former chair of ABC, spoke to how ABC’s research and technical work supports policy advocacy.

“Nearly every factor affecting profitability, including trade, water, pesticides, transportation and food safety, is shaped by government policy,” she said.

Since ABC cannot lobby, the Alliance relies on its data to explain real-world impacts to policymakers. It is a partnership that helps create wins, which Rodriguez pointed to, including past tariff disputes and the ongoing debate over ultra-processed food labeling as examples of how coordinated advocacy protects demand and grower returns.

Market Stabilization and Returning Momentum

Board Chair Bob Silveira said that while growers have endured significant hardship, the market is shifting.

Noting that average grower returns improved from about $1.60 per pound in the 2023 crop to about $2.30 per pound in the 2024 crop, he said the industry is coming out of it.

“It is going to start showing up in people’s returns,” Silveira said. “It is not enough, but it is moving in the right direction.”

He pointed to declining supply as a major turning point, noting that total supply has fallen five years in a row, helping bring supply and demand back into balance. He also credited growers, handlers and industry partners for adapting during the downturn.

“This is not the first time we have been through this,” he said. “The trend is our friend.”

ABC continues to invest heavily in demand building. About 80% of the organization’s budget goes toward global marketing, research, technical and regulatory work, and USDA grants have expanded the reach of those programs.

“We are looking at every penny and constantly evaluating whether programs truly deliver value,” Silveira said.

What Comes Next

As the session closed, Turner urged growers to stay engaged as the industry works to regain stability, emphasizing that ABC’s direction is shaped directly by grower input through surveys, committee work and on-farm stewardship reporting. She noted that demand remains strong despite headwinds and said the organization has aligned its priorities and programs to help move the industry forward.

Turner said California almond growers continue to meet some of the highest standards in the world, and that their stewardship and ongoing innovation remain central to the industry’s reputation.

“Our shared commitment to cultivating a healthier future remains essential,” Turner said. “Working together, I truly believe we can shape a stronger future for all.”

Kristin Platts | Digital Content Editor and Social Correspondence

Kristin Platts is a multimedia journalist and digital content writer with a B.A. in Creative Media from California State University, Stanislaus. She produces stories on California agriculture through video, podcasts, and digital articles, and provides in-depth reporting on tree nuts, pest management, and crop production for West Coast Nut magazine. Based in Modesto, California, Kristin is passionate about sharing field-driven insights and connecting growers with trusted information.