The start of the new year signaled the onset of new employer laws and regulations which have an impact on how you manage your business and employees. While some of these regulations might have been on your radar, I imagine a few of these will take you by surprise and will require procedure adjustments. This article will provide an overview of these new laws and regulations as well as practical solutions for implementation.

California Wage Increase

On January 1, 2023, the new California minimum wage rate reached $15.50 for all employers, regardless of employer size. January marked the final installment of California’s seven-year minimum wage rate increase. Moving forward, employers will need to continue to plan for increases as high as 3.5% each year to reflect annual cost of living increase. The Governor is required to make the minimum wage determination by September 1 for the next year, which gives businesses a short window to plan for their employee costs in the next calendar year. Additionally, pay close attention to your local ordinances as some have imposed minimum wage rates higher than the state. For example, the cities of Sonoma, Santa Rosa and Petaluma have minimum wage rates currently higher than $15.50 per hour, and as an employer in those communities, you would be required to pay those higher rates.

In addition to increasing the minimum wage, legislation also created a parallel wage increase for overtime exempt employees. The law requires exempt employees to earn twice the minimum wage rate. For instance, in 2023, all employees are required to compensate exempt employees at no less than $31 per hour with a 40-hour workweek with an annual salary of $64,480. And just like the minimum wage requirement, a yearly increase, not to exceed 3.5% in one year, will be enacted after reaching the $31 an hour rate. For additional questions on these wage increases, please visit the State of California’s Department of Industrial Relations FAQs at dir.ca.gov/dlse/sb3_faq.htm.

Overtime for Agricultural Workers

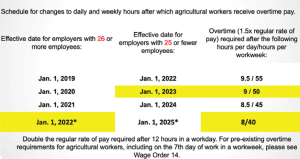

In 2016, the California legislature also passed Assembly Bill 1066 which created a gradual timetable for agricultural workers as defined by Wage Order 14 to receive overtime pay like those in other industries. In January 2022, large employers (those with more than 26 employees) and in January 2025, small employers (those with 25 or less employee), are required to pay overtime to workers once they work more than an eight-hour day or more than 40 hours in a workweek. AB 1066, now in its fifth year of implementation, requires large employers to pay overtime at 1.5 regular rate of pay if an employee works more than eight hours in a day or more than 40 hours in a workweek. Small employers, on the other hand, pay overtime wages once a worker reaches more than nine hours in a day or 50 hours in a workweek.

Please note: Overtime requirements on the seventh consecutive day of work in a workweek have not changed. Employers are mandated to pay overtime at time and one-half time for the first eight hours of work and double-time for all hours worked after eight hours on the seventh consecutive day of work in a workweek. Please see the chart for an annual adjustment of regular pay for a workday and workweek.

Bereavement Leave

AB 1041, which went into effect on January 1, 2023, applies to all employers with five or more employees. This regulation entitles employees up to five days of unpaid leave within three months of an immediate family member’s death. To qualify for unpaid leave, the employee needs to have worked for at least 30 days. Under this regulation, an immediate family member is defined as a spouse, or a child, parent, sibling, grandparent, grandchild, domestic partner or parent-in-law. Ensure you communicate this benefit to your employees and include this update in your employee handbook.

Equal Pay Act

There are two components to SB 1162 which seeks to identify and eliminate wage discrepancies based upon employee race and or gender identity. The first part of the regulation requires employers with 15 or more employees to include pay scale information for all positions offered and posted to third party recruiters. Additionally, this information needs to be provided to current employees upon request. Information on pay scale ranges must be retained through the term of employment and three years after their tenure. Penalties for non-compliance are steep and range from $100 to $10,000 per violation. To help ensure compliance, review all your positions and the pay rates associated with your employees. Document ranges of employee positions, and if you identify any discrepancies, fix the issue immediately. When an employee requests pay scale information, ensure it is provided promptly.

The second part of the wage transparency regulation applies to employers with 100 or more employees and their requirement to provide pay data reporting to the California Civil Rights Department (CRD). Employers in this category began providing pay data to CRD last year; however, SB 1162 adds additional reporting requirements which are substantial.

Additional changes are as follows:

Requires a private employer that has 100 or more employees hired through labor contractors within the prior calendar year to file a Labor Contractor Employee Report covering the employees hired through labor contractors in the prior calendar year. The employer must also disclose the ownership names of all labor contractors used to supply employees. Labor contractors are required to supply all necessary pay data to the employer.

Requires that Payroll Employee Reports and Labor Contractor Employee Reports include the mean and median hourly rate of employee groupings (that is, groupings of employees with the same establishment, job category, race/ethnicity and sex.)

Eliminated the option for an employer to submit a federal EEO-1 report to CRD in satisfaction of its state pay data reporting requirement.

Changes the annual deadline for submitting pay data reports to the second Wednesday of each May.

Authorizes CRD to obtain penalties against employers that fail to timely file their pay data reports, as well as against labor contractors that fail to provide data to client employers who must submit Labor Contractor Employee reports.

If you have over 100 employees, which includes farm labor contract employees, be sure to start this process early. There are several resources on the CRD website, including excel spreadsheet examples. To review templates, resources and FAQs, please visit calcivilrights.ca.gov/paydatareporting/.

These are just a few of the new laws and regulations which will impact the industry in 2023. It is always a best practice to check in with your counsel annually to ensure your employee handbook reflects applicable regulations and your workplace practices are compliant. This practice can be costly; however, when considering liability and penalties for non-compliance, it is a strategic use of financial resources and mitigates risk. If you have questions or need assistance with implementing any of these new laws and regulations, please contact us at safeinfo@agsafe.org or call us at 209-526-4400 and we would be delighted to assist.

Since its formation in 1991, AgSafe has trained over 100,000 growers, farm labor contractors, packers, shippers and processors, along with their supervisors and workers, in the most critical safety, health, human resources and pesticide compliance issues.