As the fastest-expanding tree nut industry in California, the pistachio industry has experienced a significant transformation over the past decade. Driven by steadily expanding pistachio-bearing acreage, the U.S. has become the largest producer, exporter and consumer of pistachios globally, establishing itself as the dominant force in the world market. Profitability and orchard resilience to droughts and salinity have been relevant drivers to recent planting expansion. As the U.S. pistachio industry is likely to experience a massive supply increase, efforts to create demand, such as marketing innovation and research on healthfulness, will continue to be critical to support prices. Continued adoption of economically sustainable practices will maintain positive margins for efficient operators.

Producers Still Favor Pistachios

The industry will be in a different stage of the business cycle soon.

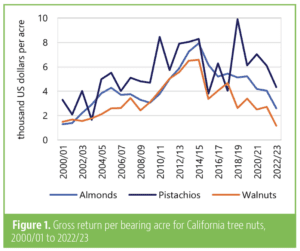

Throughout the past two decades, pistachios have offered higher gross returns per bearing acre in California than almonds and walnuts. The very few exceptions to this trend include the 2003/04 and 2015/16 seasons when, due to weather anomalies, average pistachio yield was unusually low and/or the proportion of blanks was extraordinarily high. Over the past decade, pistachio gross returns averaged $6,400 per acre, 20% and 70% higher than those for almonds and walnuts, respectively (Fig. 1).

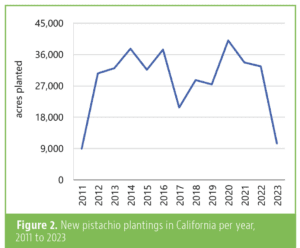

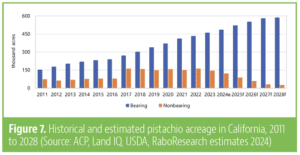

In response to attractive returns and orchards’ superior resilience to salinity and drought, growers increased pistachio plantings, ushering in a decade of rapid growth beginning in 2012. That year, estimated new plantings surpassed 30,000 acres for the first time on record. Average plantings from 2012 to 2022 were 32,060 acres per year, according to industry estimates. In total, between 2011 and 2023, pistachio-planted areas in California increased by over 372,000 acres (Fig. 2). With this expansion, the pistachio-bearing area is likely to approach 590,000 acres by 2028. As a reference, in 2011, pistachio-bearing acreage was about 153,000 acres and nonbearing acreage was roughly 73,000 acres, per industry figures.

Unlike common downward price pressure in the past few seasons (Fig. 1), acreage trends in each of the major tree nut industries in California differ. While pistachio-bearing acreage is expected to continue to expand, almond and walnut acreages are at different stages in the business cycle.

Industry-wide supply-side challenges, such as the impacts of the implementation of the Sustainable Groundwater Management Act (SGMA) in California, are expected to restrict new plantings across the tree nut industry and potentially reduce production acreage in areas with marginal lands and limited access to water. In pistachios, it is expected that the incentives for new plantings will be reduced, ending a period of rapid growth and initiating a maturity stage in production.

U.S. Now Dominates the Global Pistachio Market

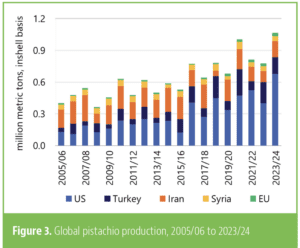

Between 2005/06 and 2015/16, the U.S. and Iran went back and forth holding the title of largest pistachio-producing country in the world, with the U.S. leading in six of these years and Iran in the remaining five. Since 2016/17, driven by a steadily expanding bearing acreage, the U.S. has established itself as the indisputable largest producer of pistachios, per USDA statistics. U.S. pistachio production went from 128,400 metric tons (about 283 million pounds), or 32% of global output, in 2005/06 to about 667,100 metric tons (roughly 1.5 billion pounds), accounting for 63% of global production in 2023/24. Turkey and Iran accounted for 15% and 14% of the global pistachio crop, respectively, in 2023/24 (Fig. 3).

Global pistachio production expanded at a compound annual growth rate of 5% in the past decade, while U.S. production grew at a 10% compound annual growth rate (CAGR). During the same period, production in Turkey expanded at a 7% CAGR, and production in the EU, primarily in the Iberian Peninsula, grew at a 9% CAGR from a much smaller base. Among the primary growing regions, Iran’s crop declined at a 4% CAGR during the past decade, given challenging growing conditions, including droughts and freezes.

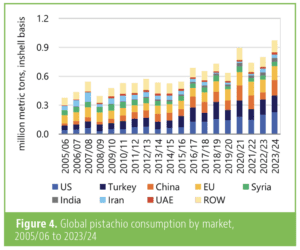

Since 2019/20, the U.S. has also become the market with the highest pistachio consumption, a position that previously belonged to Turkey or the EU, depending on the year. Relevant demand drivers, besides attractive product attributes, such as convenience and taste, include product/packaging innovations, health research and promotional efforts as well as availability of quality product year-round in an increased number of package sizes and presentations.

Pistachio consumption in the U.S. increased from 41,500 metric tons in 2005 to 225,000 metric tons in 2023/24. Four key markets for pistachios are the U.S., Turkey, China and the EU, accounting for a combined 72% of global consumption, per USDA estimates. Over the past decade, pistachio consumption has increased in the U.S., Turkey, China and the EU, expanding at CAGRs of 13%, 7%, 5% and 6%, respectively. In India, which absorbs 4% of the world’s pistachios, consumption has expanded at an 11% CAGR in the past 10 seasons (Fig. 4).

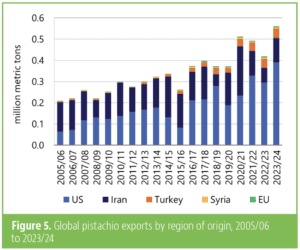

The global pistachio trade scene went from Iran leading as exporter to a decade of head-to-head competition between Iran and the U.S. in terms of volumes exported to a clear U.S. dominance in the past few seasons. U.S. exports went from 64,000 metric tons, or 31% of global exports, in 2005/06 to a record-setting 390,000 metric tons, accounting for 70% of global exports in 2023/24 (Fig. 5). Food safety and consistent quality are two factors that will continue to provide U.S. pistachios a competitive advantage.

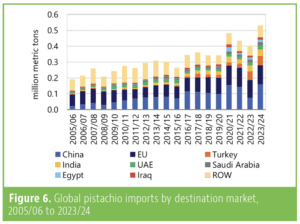

As for imports, the largest destinations for international shipments include China, the EU, Turkey and India. Middle Eastern markets, such as the United Arab Emirates, Saudi Arabia, Egypt and Iraq, also make the top-10 list of pistachio importers, per USDA. All these markets, except the UAE, showed import growth in the past decade (Fig. 6). Market development and expansion will be critical to absorb the upcoming increasing pistachio volumes.

More California Pistachios on the Way

As explained in RaboResearch’s previous pistachio report, by 2026, pistachio-bearing acreage is expected to be almost seven times that of 2000. Naturally, as new plantings (Fig. 2) transition into the production stage, this trend is expected to continue. By 2028, close to 590,000 acres will likely be bearing, accounting for about 95% of total plantings. As a reference, in 2017, bearing acreage was 62% of total planted area. Since plantings slowed starting in 2023, we expect nonbearing acreage will decline in the next few seasons, while bearing acreage will stabilize after 2028 (Fig. 7). In the longer run, the potential impact of SGMA on acreage remains a wild card, as some predict bearing area may be reduced by up to 100,000 acres due to SGMA-related water restrictions.

Production and Exports Will Continue to Expand

As a higher proportion of orchards will reach the full production stage, pistachio production in California is expected to set new records during ‘on’ years ahead. Likely on years are 2025/26 and 2027/28, with production expected to surpass 1.5 billion pounds and 1.6 billion pounds, respectively. Average yields this season were lower than last year’s given a mild winter and heterogeneous pollination conditions.

The U.S. pistachio industry has thrived in part on opportunities in international markets and its ability to serve these markets in a timely manner. Of particular relevance is the season previous to the Chinese New Year, the largest demand pull of the year for U.S. pistachios, when the gifting of pistachios is a sign of good tidings. About 30% of U.S. pistachio exports during the 2023 calendar year had China as a direct destination. Also, roughly 56% and 43% of U.S. pistachio exports during November and December of 2023, respectively, were directed to China. On the flip side, a heavy reliance on a single market and season is seen by some as a source of geopolitical risk, which highlights the need to diversify destination markets and improve market access.

Price Outlook

As the industry is required to move a record crop in 2023/24, initial prices were announced below historical levels. As shipments were strong during most of the marketing year, some sources reported recovering prices. For the 2024/25 season, some opening prices were at similar levels as the year before, but given the shorter crop, it is likely prices will improve ahead. With lower supplies this season, there’s a possibility of very low inventories at the end of the season if shipments remain strong. This is likely to help prices remain relatively steady at the beginning of 2025/26, even though it is expected to be an on year.

The average of our price estimates for the period 2024/25 to 2028/29 is around $2.10 per inshell pound. For 2027/28, we estimate an 80% chance of prices being between $1.80 and $2.20. Our probabilistic estimates intend to capture reasonable variability that is likely to materialize from the supply side (weather events that will determine yields and supplies) and from the demand side (trade policies, exchange rate movements, consumer willingness to pay, etc.).

Pistachio prices have remained steadier than those of competing tree nuts in the past few seasons. As price rebounds are expected in almond and walnut, pistachio prices are likely to benefit from these trends. However, with increasing pistachio volumes looming, demand creation will be critical to avoid unsustainable price pressures. Moreover, pistachio prices have fluctuated less than pistachio production volumes have in recent years. Enhanced yields have the potential to compensate grower revenue during on years with a lower-priced crop. However, more than ever before, the continued adoption of improved economically sustainable practices in production, processing and marketing will be imperative to support profitability.

RaboResearch F&A North America provides dynamic insight and value to tree nut industry members, and other Rabobank clients and stakeholders. Learn more about the exclusive research reports for a competitive edge at raboag.com/raboresearch/overview-125.