The Market Facilitation Program (MFP) provides assistance to farmers and ranchers with commodities directly impacted by unjustified foreign retaliatory tariffs, resulting in the loss of traditional export markets. According to the United States Department of Agriculture (USDA), “Assistance is available for agricultural producers of non-specialty crops, dairy, hogs, and specialty crops.” Housed within specialty crops is funding for almonds, hazelnuts, macadamia nuts, pecans, pistachios, and walnuts.

On May 23, 2019 Agriculture Secretary Sonny Perdue announced that the USDA would again provide aid to assist farmers hurt by trade disturbances brought on by foreign retaliatory tariffs. This aid is being provided through MFP. The USDA was authorized by President Donald Trump, to provide direct payments through MFP for 2019. The goal of MFP is to assist impacted growers who had impacts of the retaliatory tariffs off their commodity.

In a press release from the USDA, it was described there would be a, “$16 billion package aimed at supporting American agricultural producers while the Administration continues to work on free, fair, and reciprocal trade deals.” The thought is presumed that while negotiations play out for a possible trade resolution, the USDA is willing to assist growers with any losses they may incur. From the lack or minimal movement of agriculture crops into countries with high trade tariffs, many growers are feeling

Agriculture is an industry comprised of businesses. Businesses with bills to pay, crops to sell and land to care for. All of this takes money and cash in the bank to operate. Many growers are being dealt the short straw of the current trade war. Growers are finding themselves as collateral damage. They are having a hard time paying bills and staying up to date on their business expenses. The Trump administration is aware and sympathetic to the situations. The MFP is trying to minimize the detriment being done to American farmers.

MFP Payments

A first round of MFP payments went out in 2018. Growers applied and were granted payments based on a series of standards and qualifications. A main qualification was the average adjusted gross income (AGI) less than $900,000 for the immediate three crop years. Almond growers could apply for direct payments of $.03 per pound as part of the trade mitigation package. Payments were limited to a total of $125,000 per person or legal entity.

To an agriculture business, the gross income cap is rather low. The low AGI cap was disqualifying many growers from being able to receive the MFP funding. Small growers with one entity made too much money. Larger growers with multiple entities could use their several different entities and collect relief payments. The length of the application and the intrusive amount of records the 2018 application required also took growers many trips to the Farm Service Agency to figure out what was needed. It was a tedious and lengthy application that many just didn’t have the time and resources to complete. The 2018 MFP was being criticized as only helping the large farmers and leaving the small farmers behind.

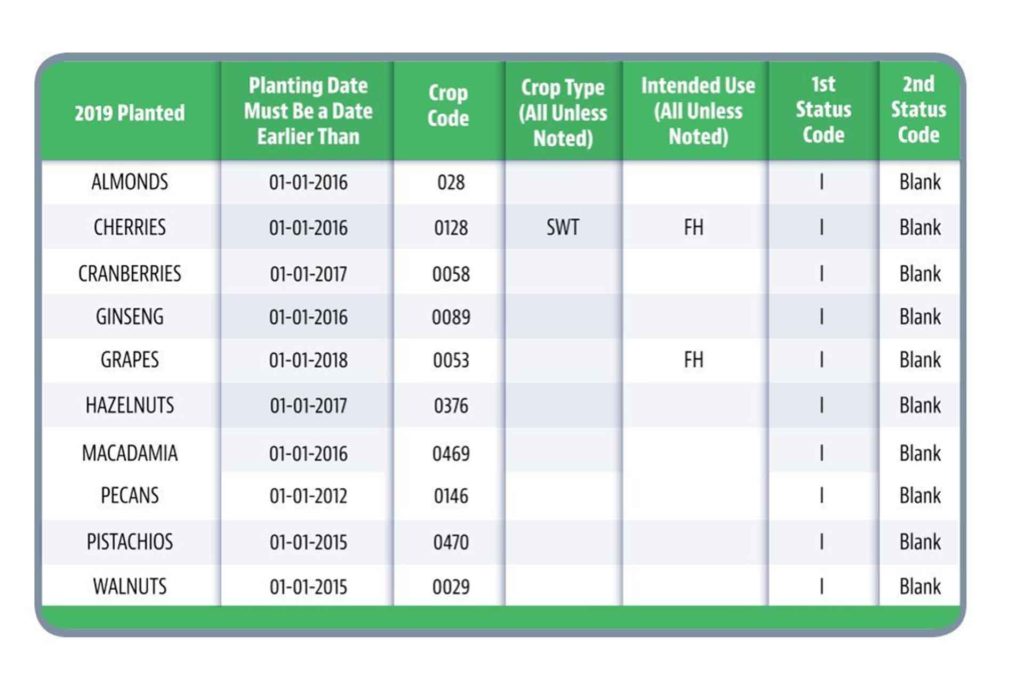

Now this year, as long as 75 percent or more of their average Adjusted Gross Income was derived from farming for the last three tax years, you may qualify. The payment limit also increased to a combined $250,000 for specialty crop growers. With no entity to receive more than $500,000. The specialty crops eligible to receive payments include almonds, hazelnuts, macadamia nuts, pecans, pistachios and walnuts as well as some fresh fruits. Pistachio and walnut trees had to be planted earlier than January 1, 2015. Almonds must be planted earlier than January 1, 2016. Pecans had to be planted earlier than January 1, 2012. There is no yield qualification. Pistachios, almonds and walnuts will all receive $146 per acre.

2019 MFP Funding

To qualify for 2019 MFP funding, you must apply through your Farm Service Agency (FSA). There is an application available online as well as a checklist to follow and ensure you are not missing any of the application. It would be ideal to fill out the application this year with the help of your local FSA office. It is recommended to make an appointment with your FSA office and coordinate time to go over the application process in person. There are also multiple Crop Insurance agencies lending assistance with the process. Crop Insurance agents are very familiar with the FSA filing processes and may be able to help prepare you for your FSA appointments.

The Form CCC-913 appears to be much simpler and easier application this go around. The steps that go along with the application are what will take more time to apply. The following steps are a helpful guideline provided by the Almond Alliance and Almond Board of California as a guidelines.

- File Form CC-913, 2019 Market Facilitation Program Application.

- You also need to ensure your acreage is on file with the Farm Service Agency and matches what your records indicate. This may take an extra step to ensure your farm acreage is listed with the FSA office.

- File Form CCC-941 to ensure your average adjusted gross income (AGI) certification and consent to disclosure of tax information. This is to ensure your AGI is less than the $900,000 threshold. If you are not less than the threshold, than you must file a CCC-942 to confirm that 75 percent of your AGI comes from farming. You will also need these forms to be signed by your attorney or accountant.

- File Form AD-1026 Highly Erodible Land Conservation and Wetland Conservation Certification

- File Form CCC-902 Farm Operating Plan for Payment Eligibility and Subsequent years and CCC-901-member information. This form is to identify the members and shareholders of a legal entity for all partners.

- File Form FSA-578 Crop Acreage Report for each farm or parcel you are applying for. This may be a step already completed if you have previous FSA dealings.

- File Form SF-3881 Vendor Miscellaneous Payment enrollment form is to ensure the correct entity will be set up for direct deposit payments. A voided check will need to be provided.

- File Form AD-2047 Customer Data Worksheet Request for Business Partner Record Change. If you have not previously applied with the FSA they will require the legal name, address, contact, and social security numbers of all partners and members of your farming entity.

- If you have not filed with the FSA before you will also need land ownership documents such as a recorded deed or rental agreement for all land you are applying for. As well as signature authority granting certain individuals to sign on behalf of your entity. This may be a estate or trust document and will be needed for all entities.

You can also reapply for the 2018 payments as well. If you applied last year and did not receive funding, you are welcome to apply again this year for both 2018 and 2019 funding. If you meet the 2019 standards, you will need to fill out the 2018 application again to see if you requalify. Application deadline is December 6th.

MFP Payment Schedule

According to the farmers.gov USDA website, MFP payments are divided into three parts. The first payment will be fifty percent of your calculated payment and will be issued soon after the application is submitted and you are deemed eligible. If the Commodity Credit Corporation (CCC) determines you are eligible for more payments you will receive the second and third payments in installments. It appears that as long as the barriers of trade that currently are in place exist and no agreement has been reached, the installments will take place. If a trade agreement is reached then the MFP payments will stop. The second payment will be in November 2019 and will equal half of the balance or twenty-five percent of the total payment. The third payment will be in January of 2020 and will be the remaining balance of the total payment. Funds are based on the condition of the trade barriers and will not be granted after an agreement has been reached. It is recommended to meet with your FSA office and apply for funds as soon as possible.