For many years, both the state legislature and California’s governor have expressed concern over the long-term future of our workforce. Across industries, many employees do not have access to company-sponsored retirement programs. While opening personal individual retirement investment accounts is an option, in the eyes of our elected officials, without an employer serving as the impetus for that action, it just wouldn’t happen. This train of thought led to the creation of CalSavers, a California-sponsored individual retirement program, which continues to move forward throughout this COVID-19 pandemic. It is essential that agricultural employers understand the program, their role in it and how it will impact their workforce.

What is CalSavers?

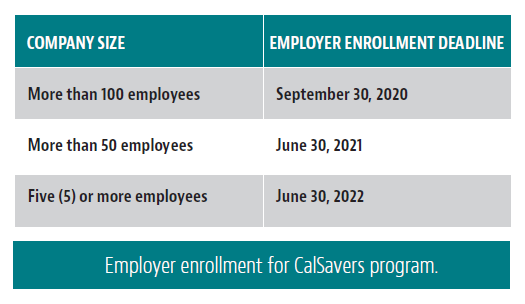

In 2016, the legislature passed, and the governor signed into law, Senate Bill 1234, which established the CalSavers program. Employers with five or more employees who do not offer a company-sponsored retirement program are required to enroll in the CalSavers program. The program is also available to self-employed individuals seeking a retirement savings vehicle. Participants will then have an Individual Retirement Account (IRA) set-up and managed by the CalSavers team. Critical deadlines are approaching for employer enrollment that has not been extended amid the current COVID-19 crisis (see table).

Employer Responsibilities

Employer registration will require the submission of the following information:

- Federal Employer Identification or Tax Identification Number (EIN/TIN)

- California Employer Payroll Tax Account Number

- CalSavers access code from your employer notification

In addition to registering, employers will need to provide information on all employees at the time of registration and then on an on-going basis moving forward. The employer is responsible for sharing with CalSavers their employees’ names, Social Security or Tax Identification Number and their applicable contact information. It is important to note that an employer must provide the information for all workers, full-time, part-time, regular, and seasonal, and regardless of the length of time they have worked for the business. Once the initial registration is complete, employers must report new eligible employees within 30 days of their date of hire to CalSavers. The program has developed templates to assist employers in organizing and submitting this information.

Employers are also responsible for coordinating payroll deductions for each pay cycle. The funds will be withheld from an employee’s wages after taxes and automatically provided to CalSavers for inclusion in their IRA. For 2020, employees under the age of 50 will contribute an annual maximum of $6,000 and employees over the age of 50 will contribute an annual maximum of $7,000. Employees will be charged a fee between 0.825% – 0.95%, depending on their investment choice. Those fees will be taken directly from their contributions and they will not receive a bill. CalSavers will work with employers to ensure the correct amount is being withheld each pay period relative to these maximums.

It is essential to understand that employees are automatically enrolled in CalSavers. Once an employer provides employee information to CalSavers, they will contact the employees directly about their participation and investment options. If the employee does not want to participate, he or she must opt out within 30 days of the employer providing their information to CalSavers. In addition, the employee must opt out with CalSavers directly and not with the employer.

This latter detail is critical to understand and should be the cornerstone of employer communication about CalSavers with their workforce. It is incumbent upon employers to inform all employees of the program when the employer has provided employee details to CalSavers, that the employees should expect to receive communication from CalSavers directly about participating in the program, and how the money will be provided to CalSavers. Many in the agricultural workforce will be confused and even frustrated when additional post-tax money is taken out of their paychecks and ultimately, it will fall on the employer to communicate the legal mandate of the program, along with information on how the employee may opt out.

The program is also very prescriptive about an employer’s responsibility to remain neutral about employees’ decision to participate in the program. Communication should be focused on the facts about CalSavers and encourage contact with the program directly when employees have questions or concerns. Senate Bill 1234 did include language noting that employers shall not have any liability for an employee’s decision to participate in the program, for their investment decisions or, for the performance of those investments. The final point is obviously critical in these current times and CalSavers has released the following details regarding investment performance:

We continue to ensure the safe custody and investment of your contributions and timely processing of account requests. We are closely monitoring the financial markets and the performance of the CalSavers portfolios. Please know that our program and portfolios were developed with the understanding that markets can be volatile. In addition, unless you have actively chosen otherwise, the first $1,000 of your CalSavers contributions are invested in a Capital Preservation Fund that helps protect your savings from market volatility. We deeply hope that our savers do not experience financial hardship, but if you do find yourself in need, you may call us to learn more about your options to access your contributions.

CalSavers has also issued the following statement to employers about participation moving forward:

We know that many employers are facing unprecedented challenges right now. CalSavers is committed to supporting employers through these uncertain times by offering extra support and flexibility. If you’re ready to begin facilitation, please engage with our support team so we can make it easy for you. If your deadline is coming up on June 30th and you aren’t sure you will be ready to participate, please call us.

All that being said, the program continues as originally planned and that includes the penalty structure for an employer’s failure to participate.

Employer Penalties

Senate Bill 1234 included monetary penalties for employers that fail to allow eligible employees to participate in CalSavers. If an employer does not register or fully engage in the program 90 days after service of notice from the state, the state can levy a penalty of $250 per eligible employee. Should non-compliance extend beyond the initial 90 days and the employer is found to still not be complying 180 days after the notice, an additional penalty of $500 per employee will be issued. Ultimately, the failure to register and provide the needed support to participating employees can become quite costly. To learn more about CalSavers, visit www.calsavers.com

For more information about worker safety, human resources, labor relations, pesticide safety or food safety issues, please visit www.agsafe.org, call (209) 526-4400 or email safeinfo@agsafe.org. AgSafe is a 501c3 nonprofit providing training, education, outreach and tools in the areas of safety, labor relations, food safety and human resources for the food and farming industries. Since 1991, AgSafe has educated over 85,000 employers, supervisors, and workers about these critical issues.