It is that time of the year when many new employment law regulations took effect when the clock struck midnight on Jan. 1. In addition to the list of policies and programs you launched last year, including your COVID-19 Prevention Plan, I want to ensure you pay close attention to these regulations and get them integrated into your operation.

California Wage Increase

In 2016, Governor Brown signed legislation that would gradually increase minimum wage rates in California, with the intent that by 2023 all California employees would earn at least $15 per hour. Jan. 1, 2021 marks the fifth year of this increase. California’s minimum wage increased to $14 an hour for large employers (those who employee 26 or more employees) and $13 an hour for small employers (those with less than 25 or less employees). In 2022, large employers will reach the $15 per hour threshold, while small employers will reach $15 per hour in 2023. Please note that once employers reach the $15 per hour rate, every year following there will be a 3% cost of living increase added to minimum wage. Additionally, pay attention to your local ordinances as some have imposed minimum wage rates higher than the state. For example, the cities of Sonoma, Santa Rosa and Petaluma have minimum wage rates currently of $15 an hour or higher for large employers, and as an employer in those communities, you would be required to pay those higher rates.

In addition to increasing minimum wage, this legislation also created a parallel wage increase for overtime-exempt employees. The law requires exempt employees to earn twice the minimum wage rate. For instance, in 2021, large employers are required to compensate exempt employees at no less than $28 per hour with an annual salary of $58,240. By 2022, large employers, followed by small employers in 2023, will be required to pay their exempt employees a minimum of $62,400. And just like the minimum wage requirement, a 3% yearly increase will need to be enacted after reaching the $30 an hour rate. For additional questions on these wage increases, please visit the State of California’s Department of Industrial Relations FAQ’s at dir.ca.gov/dlse/sb3_faq.htm.

Overtime for Agricultural Workers

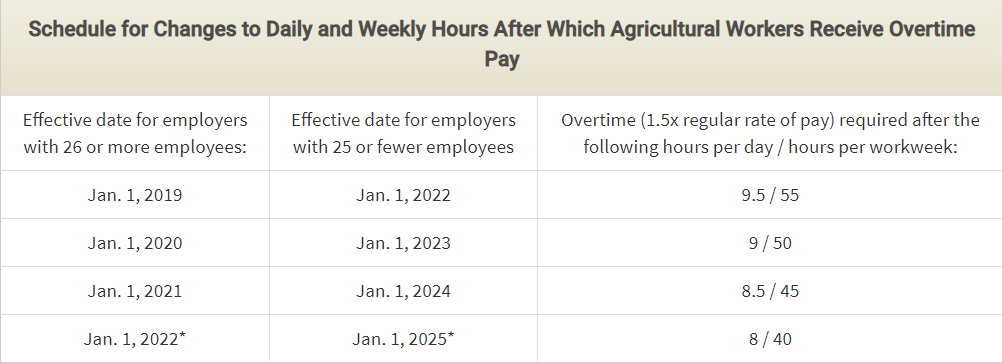

In 2016, the California legislature passed Assembly Bill 1066, which created a gradual timetable for agricultural workers, as defined by Wage Order 14, to receive overtime pay like those in other industries. Large employers in January 2022 and small employers in January 2025 will be required to pay overtime to workers once they work more than an 8-hour day or more than 40 hours in a work week. AB 1066, now in its third year of implementation, requires large employers to pay overtime at 1.5 regular rate of pay if an employee works more than 8.5 hours in a day or more than 45 hours in a work week. Beginning in 2022, small employers will need to begin complying with this regulation and pay overtime wages once a worker reaches more than 9.5 hours in a day or 55 hours in a workweek.

Please note that overtime requirements on the seventh consecutive day of work in a work week have not changed. Employers are mandated to pay overtime at time and one-half time for the first 8 hours of work and double-time for all hours worked after 8 hours on the seventh consecutive day of work in a workweek. Please see the chart for an annual adjustment of regular pay for a workday and work week.

California Family Rights Act

This January also brought significant changes to California Family Right Acts (CFRA). Previously, CFRA did not require employers to provide family care and medical leave if your business employed less than 50 people. Additionally, employers with 20 or fewer employees were excluded from providing baby bonding leave through the New Parent Leave Act. However, Senate Bill 1383 expanded the scope of these leaves and now requires employers with at least five employees to provide eligible employees 12 work weeks of unpaid job-protected leave during any 12-month period for eligible reasons covered by this legislation. The legislation also expanded the scope of leave if the employee elected to bond with a new child of the employee or to care for themselves or a child, parent, grandparent, grandchild, sibling, spouse or domestic partner. It is important that your business updates your employee handbook to reflect this new legislation and ensure you communicate these changes in your policies with your employees.

As you are gearing up for your 2021 season and find yourself in need of assistance implementing these new wage hour regulations or need to update your employee handbook, please feel free to contact the AgSafe team.

For more information about worker safety, human resources, labor relations, pesticide safety or food safety issues, please visit agsafe.org, call (209) 526-4400 or email safeinfo@agsafe.org. AgSafe is a 501c3 nonprofit providing training, education, outreach and tools in the areas of safety, labor relations, food safety and human resources for the food and farming industries. Since 1991, AgSafe has educated over 85,000 employers, supervisors and workers about these critical issues.