When Buttonwillow farm manager Greg Actis planted 200 acres of almonds in 2019, prices for the nut crop had been on a downward slope for four years.

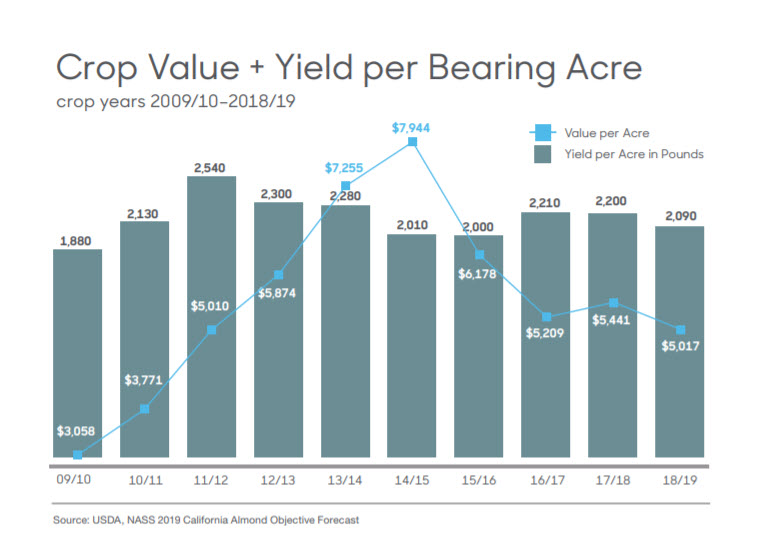

By the time he put the young trees in the black soil of the ranch he oversees, his almond prices had flattened to about $2.50 a pound, well below the $5 peak the industry saw briefly in 2015.

Today, driving past that second-leaf orchard 25 miles west of Bakersfield, Actis has seen California almond prices continue to fall. Earlier this year, prices stood at about $1.40 a pound. That’s below the cost of production for many growers, although prices had improved to around $1.70 a pound by mid-September.

“We knew the potential ups and downs associated with the almond crop and price when we planted those 200 acres,” said Actis, director of farming operations for Elk Grove Farming Co. The diversified company grows 1,200 acres of almonds and 2,000 acres of pistachios, plus cotton, alfalfa, onions and processing tomatoes.

For Actis and the rest of California’s almond industry, 2020 has been a watershed year, bringing a record crop of 3 billion pounds and historically low prices. Rabobank estimates the ongoing 2020-21 crop is 18% higher than 2019-20’s production, “a milestone that was expected to be reached by 2022 or 2023,” the bank said in its August 2020 Agribusiness Review.

Moreover, the overall almond supply, boosted by a hefty carryover from last season, is up nearly 40%, according to the August 2020 industry position report from the Almond Board of California.

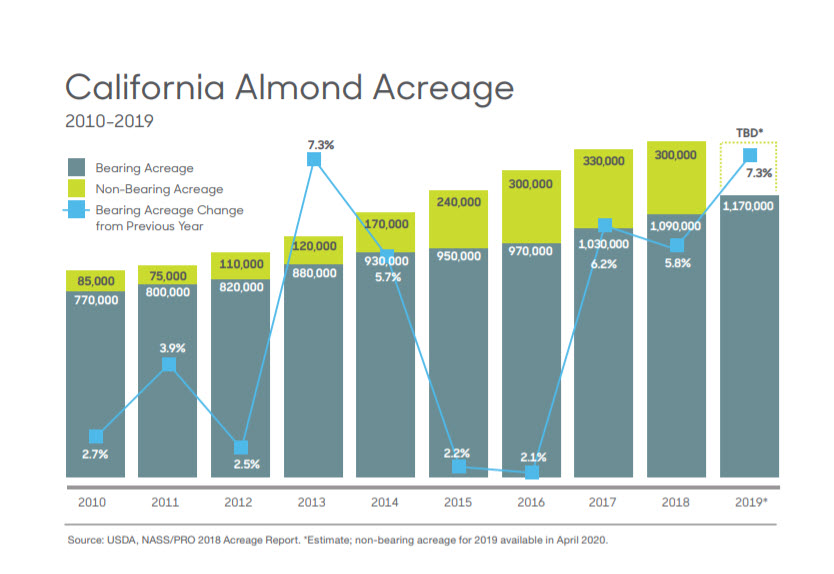

All of this comes as no surprise to the industry. California’s almond acreage has been expanding nonstop for more than a decade. Some 300,000 acres of new plantings took place between 2010 and 2019. In July, USDA-NASS estimated the state’s 2020 almond bearing acreage at 1.260 million. Others believe it’s slightly lower at about 1.251 million.

The result of all that acreage along with “existing market conditions,” Rabobank said, is that “prices are likely to remain under pressure during the next few crop cycles.”

And Then There Was COVID-19

What also has set 2020 apart, of course, is the impact of the coronavirus outbreak. Supply chain disruptions slowed export sales for almonds during the pandemic’s early months, pressuring prices lower. That was no small impact, since overseas markets account for more than half of U.S. almond shipments. During 2019-20, Rabobank said, 67% of U.S. almond shipments headed abroad.

The slowdown was especially notable in India, the industry’s largest export customer.

“COVID-19 closed India’s ports for a while,” said Lee Ann Pearce, manager of Wells Fargo’s Food and Agribusiness advisory group as well as its tree nut sector. “But its ports are opening. The August shipments report showed good sales commitments with India.”

Sluggish demand from the trade war with China and its accompanying high tariffs has also improved.

“The Chinese came in strong to the market in August, helping lift pricing for almonds,” added Pearce. “We’re also seeing increased interest in the EU and Middle East for new-crop commitments in the export market.”

Demand’s Uptick

In fact, “commitments have already crested 1 billion pounds, up 88% over last year,” noted Blue Diamond’s Bill Morecraft in the September 2020 edition of his monthly Almond Market Update. Morecraft is senior vice president at the well-known almond cooperative.

By August of this year, India had increased its in-shell shipments by a whopping 105% over August 2019 levels. “Shipments to India for September and October are also anticipated to be very strong,” wrote Morecraft.

As general manager of JSS Almonds, LLC, a Bakersfield-based processor and global marketer, Kim Kennedy follows the market carefully. He’s also seen sales and shipments increase.

“From August to present [mid-September], prices have firmed for both kernels and in-shell due to burgeoning demand from most major markets,” Kennedy said. “This demand is stimulated by both natural consumptive growth and attractive pricing.”

Kennedy believes downward pressure on almond prices “will prevail in the short term” due to 2020’s higher production. “We can expect the rate of new plantings to decrease and older orchard removals to increase in the short term as a result,” he noted.

But he also sees an upside to this year’s lower prices.

“International and domestic shipments have increased over the previous year and will continue to strengthen as cheaper prices stimulate demand around the globe,” said Kennedy.

As global consumption expands and new almond production slows, “supply and demand will be more in balance in the coming years,” he added. “The long-term outlook for almonds remains bright.”

Well Fargo’s Pearce agrees. “The market will absorb the large crop over time,” she said. “The almond industry is very innovative and will find products to meet demand.”

At Ground Level

Walking through his thriving young almond orchard, Actis remains confident his company’s decision to plant additional almond acreage in 2019 was the right one.

“Farming’s a gamble, but we’re optimistic in our investment in almonds,” he said. “We have total trust in our processors and marketers getting us, the customer, the top price.”

Further, he’s still making money on his mature almond trees. They grow in Kern County, the state’s top almond producer, where almonds have finally surpassed grapes as the top-grossing crop.

The general cost of production for Actis’ almond operation is about $3,300 to $3,600 an acre, or $1.05 to $1.20 per pound. Per-acre yields on his mature trees range from 3,000 to 4,000 pounds, well above the industry average. Further, overall turnouts from his 2020 harvest are down from last year.

Actis believes it will take 18 to 24 months for prices to return to the $2.50 per-pound range. Until then, he said, “we’ll look to control our production costs as well as we can and strive for yield and quality.

“We believe in the long-term fundamentals of almonds,” he added, “and we’re happy with where we’re positioned.”