With every new year comes the realization that almond orchards will be in full bloom before long. This article summarizes some considerations for the 2023 almond pollination season, including a discussion on how to cut pollination expenses this year while maintaining compliance with requirements for federal crop insurance.

Almond Industry Update

Many almond growers are feeling the stress of narrowing profit margins over the last couple of years. Almond prices are hovering at or below $1.75 per pound primarily due to international trade issues including supply chain disruptions at the ports (for more information, see Carter and Steinbach 2022.) For context, current prices are 20% lower than the USDA National Agricultural Statistics Service (NASS) 2017-21 average of $2.19 per lb. While almond prices have remained relatively low the last few years, input prices have increased substantially. The current state of almond profit margins likely indicates that recent trends of expanding almond acreage will slow.

The Almond Board of California and Land IQ estimate the removal of around 60,421 acres of almonds by September 2022, approximately 4.5% of the 1.3 million bearing acres in 2022. This is up slightly from 2021, when an estimated 56,949 acres where removed. According to the USDA NASS Nursery Sales report between June 2020 and May 2021, nurseries reported 41,000 acres of sales, with 24,000 for new orchards and the remainder replacing existing orchards. Compared to removals in 2022, this may be the first year in the last two decades that more acres have been removed than replanted. Though notably in 2022, only six out of nine nurseries reported sales, so this may be an underestimate of acreage planted. At the very least, it suggests a leveling off of almond acreage as opposed to the expansion that has been occurring in recent years.

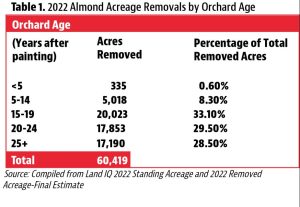

To get a better idea of what is driving these removals, I dig a bit further into the Land IQ removals report. Typically, almond orchards are thought to last 25 to 30 years after planting. Older orchards are the most likely candidates for removal; however, many have speculated the additional removal of younger orchards in the past couple of years due to water scarcity concerns from consecutive years of drought and expected limitations due to the Sustainable Ground Water Management Act. Table 1 shows the number of 2022 removals by orchard age and shows a large portion of removals (72%) were orchards less than 25 years of age, and 42% of removals occurred in orchards less than 20 years old.

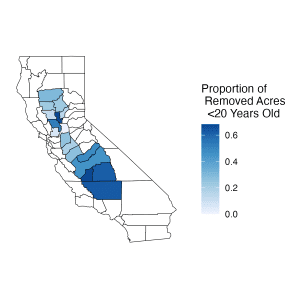

Figure 2 shows for each county the proportion of total acres removed in 2022 that were acres planted less than 20 years ago. It is clear that the southern San Joaquin Valley has seen a relatively higher proportion of young orchards removed out of total removals. This is not surprising given the southern San Joaquin Valley is generally more water stressed than the northern San Joaquin and Sacramento Valleys.

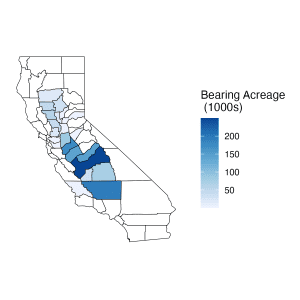

Table 1 and Figure 1 indicate that water availability coupled with narrowing profit margins may be driving growers in some areas to remove orchards earlier than in the past. Despite these removals, at least 1.3 million bearing acres of almonds remain going in to 2023. Figure 2 displays bearing almond acreage by county for 2022. The counties of Kern, Kings and Tulare, which saw relatively high proportions of young acres being removed in Figure 1, still contain significant amounts of almond acreage (about 22% of the state’s total.)

Estimated Colony Demand

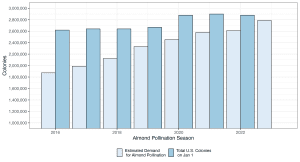

Figure 3 plots the estimated demand for colonies based on bearing almond acreage each year from 2016 to 2023 as well as the total number of colonies in the U.S. on January 1. Estimated demand is calculated using two colonies per acre for traditional varieties and one colony per acre for self-fertile varieties (Shasta and Independence). For the 2022 almond bloom, roughly 1.3 million almond acres (6% in self-fertile varieties) required an estimated 2.6 million honeybee colonies for pollination (Figure 3).

As seen in Figure 3, estimated demand for colonies in 2023 is 2.8 million colonies, roughly 8% higher than the 2.6 million required in 2022. However, given the higher rates of removals of almond acreage in recent years and the timing of USDA reporting, this 2.8 million could be a slight overestimate. In recent years, it has seemed that self-fertile variety plantings have started leveling off the estimated demand for colonies. However, the colonies that will be required for almond pollination in 2023 represent over 90% of the 2.88 million colonies in the U.S. on January 1, 2022, so at least in the short run, it’s unlikely this leveling off of demand will put downward pressure on pollination fees.

An article published in Nature found the Independence variety showed an increase in yield by 20% from allowing bee visitation (Sáez et al. 2020). This study eliminates any claims that these self-fertile varieties do not require honeybee colonies for commercial production. Growers of self-fertile varieties who do not currently place honeybees in their orchards are likely “borrowing” pollination services from neighboring orchards. In the future, growers with traditional orchard varieties surrounded by many self-fertile orchards with few (or no) colonies per acre may have to compensate by placing more colonies per acre.

Colony Supply Issues

The primary influence on the supply of available colonies for almond pollination is colony health and populations throughout the U.S. Colony health issues can impact both the strength of colonies (approximate number of bees/hive) and the total number of colonies that survive the winter. Two potential issues impacting colony health for 2023 almond pollination were Hurricane Ian hitting Florida in September 2022 and a summer drought in most of the Western U.S.

Recently, NPR reported that around 400,000 of Florida’s honeybee colonies were in the path of Hurricane Ian, and as many as 100,000 colonies were completely destroyed while others remain struggling (Rodriguez-Feo Vileira, L. 2022). This means the hurricane could have negatively impacted roughly 13% of the total U.S. colony population at the time (estimated using colony numbers on October 1, 2021.) This disruption has the potential to severely decrease the supply and strength of surviving colonies coming out of Florida for almond pollination.

Weather during the summer months can have an impact on honey production as well as bee health due to the availability of nutritious forage. Figure 4 shows the U.S. drought monitor as of July 26, 2022, displaying drought conditions across large swaths of the U.S. In particular, Texas was one of the states with the worst drought conditions. Texas is consistently one of the top five honey-producing states in the U.S. As of July 1, 2021, 138,000 colonies were located in Texas, roughly 4% of the total U.S. population at that time. Beekeepers with colonies in the areas plagued by drought may suffer higher winter mortality rates and lower colony strength of surviving colonies in addition to higher costs of feeding.

Almond Pollination Fees

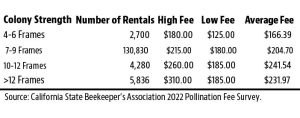

Table 2 shows the distribution of fees reported by colony strength requirement from the California State Beekeeper’s 2022 Pollination Fee Survey. The average fee for the 2022 almond pollination season for the most common colony strength requirement (seven to nine frames) was $205 per colony, though this ranged from $180 to $215 per colony. Smaller colony strength requirements of four to six frames received an average of $166 per colony, while higher colony strength requirements of over 10 frames averaged $232 to $241 per colony. The overall projected average fee for 2023 is $206 per colony, roughly equivalent to the $205 per-colony overall weighted average for 2022 suggesting that beekeepers expect fees to hold steady into 2023.

Hive Density, Colony Strength and Crop Insurance Requirements

In 2023, growers may be looking to cut expenses due to low almond prices. In 2022, 72% of almond acreage was insured through USDA Risk Management Agency (RMA) and the Federal Crop Insurance Corporation (FCIC), and in order to collect indemnities when a disaster occurs (like the frost in 2022), growers must make sure they are adhering to the requirements of crop insurance. Failure to use an adequate number of bee colonies and/or frames per colony is not an insurable cause of loss and will often be the first practice verified when a grower makes a claim. Thus, I wanted to touch on how to go about cutting pollination costs in the right way so that crop insurance requirements are met.

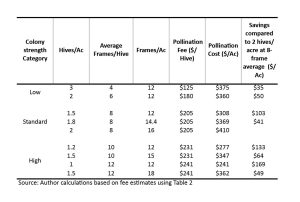

USDA and FCIC allow for substitution between colony strength and hives per acre in their almond crop insurance policy. The current policy document states as a guideline that a producer should have at minimum two colonies with six active frames, or its equivalent (USDA 2018). Technically, that means one 12-frame colony per acre or 1.5 eight-frame colonies per acre would satisfy this requirement. Almond growers can even deviate from this standard as long as they have consistently been using the same number of hives per acre and colony strength requirements and have had consecutive non-loss years (this flexibility in the policy allows growers to capitalize on benefits from self-fertile varieties that require fewer colonies per acre.)

I expect a large portion of growers in the past have been using the standard two hives per acre at an eight-frame average. Table 3 displays a few combinations of hive density and colony strength that satisfy two conditions: 1.) They meet the minimum standard defined by crop insurance (12 frames per acre); and 2.) they result in cost savings compared to renting two hives per acre at an eight-frame average. The pollination fees per hive are my estimates based on those reported in Table 2.

Table 3 shows there is flexibility when it comes to pollination expenses. Even using the lowest colony strength category (four frames) at three hives per acre can lead to cost savings at the right pollination fee per hive. The key to accessing this flexibility will be working directly with your pollination provider. If your beekeeper has already spent a substantial amount of time and inputs to provide high-strength colonies, it may not be profitable for them to make an agreement with low colony strength and corresponding low fees, in which case reducing the hives per acre for a higher colony strength category may be the mutually beneficial solution.

There are other ways to lower pollination expenses that won’t impact the number of bees per acre. Negotiating with your beekeeper to pay a portion up front for a lower fee is one option. Providing bee holding yards before bloom, locked gates in orchards, planting bee-friendly cover crops, providing guarantees against losses from pesticide exposure, or some other benefit to the beekeeper/pollination broker may also get you a lower fee, though don’t count on substantial cuts.

Almond pollination services continue to require most of the total colonies in the U.S. Even when times are tight, make sure to communicate with your beekeeper and pollination broker, and maintain good relationships to ensure a secure supply of pollinators going forward. Wishing you a happy, healthy and prosperous 2023!

Resources

Sáez, A., Aizen, M. A., Medici, S., Viel, M., Villalobos, E., & Negri, P. (2020). Bees increase crop yield in an alleged pollinator-independent almond variety. Scientific reports, 10(1), 1-7. nature.com/articles/s41598-020-59995-0

Carter, Colin A. and Sandro Steinbach. 2022. “California Almond Industry Harmed by International Trade Issues.” ARE Update 26(1): 1–4. University of California Giannini Foundation of Agricultural Economics. s.giannini.ucop.edu/uploads/pub/2022/10/24/v26n1_1.pdf

U.S. Department of Agriculture. 2018. Almond Loss Adjustment Standards Handbook 2019 and Succeeding Crop Years. Washington, DC: U.S. Department of Agriculture Federal Crop Insurance Corporation and Risk Management Agency, FCIC25020 (10-2018).

Rodriguez-Feo Vileira, Luena (2022). “Florida beekeepers rally community in Hurricane Ian recovery efforts.” NPR. National Public Radio. December 7, 2022. wuft.org/news/2022/12/07/florida-beekeepers-rally-community-in-hurricane-ian-recovery-efforts/