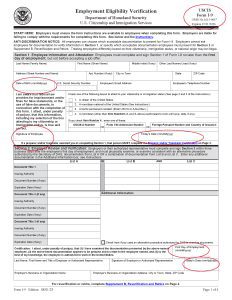

In August, the U.S. Citizen and Immigration Service (USCIS) released an updated Form I-9, which included some substantial changes. Many of the changes were welcomed as the new form has been streamlined, accounts for remote hiring practices and is compatible with digital devices. The updated form is required to be used for new hires beginning November 1, 2023. In this article, we discuss the changes in Form 1-9 and common mistakes to avoid.

USCIS utilizes the Form I-9 to verify the identity and employment authorization of individuals hired for employment in the U.S. All U.S. employers must ensure proper completion of the form for each individual hired for employment in the U.S., including citizens and noncitizens. All employers must complete and retain the I-9 for every person they hire for employment after November 6, 1986 in the U.S. as long as the person works for pay or other type of payment. Form I-9 is required to be completed for part time, full time, regular, seasonal and temporary employees.

Updated Form Highlights

Section 1 and Section 2 were reduced to a single-sided page. Multiple fields were combined, and others were eliminated.

The Preparer/Translator Certification area was moved to a separate Supplement A document for use when needed.

The Reverification and Rehire (Formerly Section 3) was also moved to a separate Supplement B document to be used when needed.

Removed use of “alien authorized to work” in Section 1 and replaced with “noncitizen authorized to work” and clarified the difference between “noncitizen national” and “noncitizen authorized to work.”

The form which is designed to be fillable, can now be downloaded on tablets and other mobile devices (use of Adobe Acrobat Reader free app).

No longer required to enter N/A in certain fields.

There is new guidance on the List of Acceptable Documents page to include acceptable receipts and the auto-extension of some documents.

Includes a checkbox allowing employers to indicate they examined Form I-9 documentation remotely under a DHS-authorized alternative procedure rather than via physical examination.

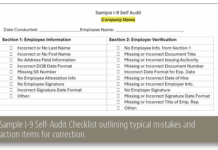

Common Mistakes

There are more than a dozen common mistakes employers make when completing the Form I-9. While these mistakes may seem minor, they could result in a fine if USCIS were to conduct an audit.

Failure to fill out Form I-9 for current employees.

Missing digits on dates. All dates on the form must be documented in the following format: mm/dd/yyyy.

Providing PO Box information rather than a physical address.

Missing employee or employer signature.

Failure to complete Section 2 within the 3 business days from the date of hire.

Improperly completing Section 2 documents (incomplete information or too much information, not examining acceptable documents, or listing expired documents).

Failure to audit Form I-9s for administrative errors on an annual basis.

Inability to write information requested legibly on form.

Failure to provide Form I-9 to ICE when requested for audit (usually within 72 hours.)

Illegible forms because of use of pencils or gel pens to complete. Black or blue pen colors are recommended when filling out the form manually. A .pdf fillable form is available for easier completion.

Utilizing a highlighter or white out on the form.

Another critical element of Form I-9 involves the proper storage of these documents. Forms must be on file for all current employees and stored securely in a way the meets your business needs. Because these forms contain personal information, only authorized employees should have access to these documents. Additionally, as mentioned previously, these documents must be made available within three days of an official request for inspection by ICE.

Another frequently asked question involves how long the Form I-9 must be kept after an individual is no longer employed. If an employee worked for less than two years, you must retain the form for three years after the date entered in as the first day of employment. However, if you have an employee who has worked for more than two years, you must retain their form for one year after the date they stopped working for you.

For additional details on the Form I-9, please visit USCIS at uscis.gov/i-9central. If you should have specific questions regarding your Form I-9 or your hiring best practices, please contact the AgSafe team at 209-526-4400 or email safeinfo@agsafe.org.

AgSafe is a 501c3 nonprofit providing training, education, outreach and tools in the areas of safety, labor relations, food safety and human resources for the food and farming industries. Since 1991, AgSafe has educated over 85,000 employers, supervisors and workers about these critical issues.