California agricultural employers know the new year inevitably brings new workplace laws that are finalized at the end of the California state’s legislative session in the fall. This year, California state lawmakers considered over 2,700 bills, the most in almost two decades, including some high-profile workplace-related proposals. Governor Newsom had until October 14 to sign or veto the bills on his desk, so we now know what new compliance obligations employers will soon face. Agricultural employers will need to review the flurry of bills that were approved. To assist with this task, below is a discussion of the four major developments facing agricultural employers in 2024.

1. Card Check

The 2022 shock to the industry, AB 2183, commonly known as the “card check” bill, became a reality this year. As promised, Governor Newsom signed AB 113 on May 15 of this year, removing the “Labor Peace Compact” portion of the original legislation, leaving two pathways to unionization of agricultural employers: 1) The old secret ballot method, or 2) The card check process or “Majority Support Petition.” As a result, the industry has seen attempts by the UFW to unionize California employers across the state.

Even though card check unionization has already started, the Agricultural Labor Relations Board (ALRB), who reviews union petitions and oversees the election process, is still “in the process of developing regulations” to implement the provisions of AB 113. Given the regulations are not even written but elections are moving forward anyway, employers are at a significant disadvantage when navigating this framework. In a card check election, the very first time an employer may hear about the union is when the Petition is served, and the employee’s “cards” have already been signed. Moving into 2024, what can employers do?

Supervisor Training

Now is the time to train (and retrain) supervisors and foremen on what unionization would mean to your company, how to talk to employees about a union, and how words or actions can become “Unfair Labor Practices” (ULPs) that lead to ALRB action and investigations.

No Trespassing

In 2021, the U.S. Supreme Court said the ALRB regulation requiring union “access” to agricultural employers’ property was unconstitutional. Managers, supervisors, and foremen should know what to do if trespassers (including union organizers) show up on company property and how to respond. Employers should also post “No Trespassing” signs.

Build the Team

In the event of a campaign, employers must move quickly (within a matter of hours) to prepare employee lists, respond to the ALRB and begin strategizing about a response. Build your team now so your first step isn’t figuring out who to call and who is in charge. Plan now and have the plan in place, just in case.

PAGA

California employers had a brief moment of celebration after the U.S. Supreme Court held that an employee’s claim under California’s Private Attorney General Act (“PAGA”) is subject to arbitration if the employee signed a valid agreement in the Viking River Cruises Inc. v. Moriana case, decided in 2022. This year, the California Supreme Court responded in the Adolph v. Uber decision, holding if an employee’s individual PAGA claim was subject to arbitration, that employee could still represent other “aggrieved employees” and pursue a PAGA claim against the employer in court on behalf of their co-workers. This decision changed the ever-evolving PAGA landscape and means PAGA cases will remain a huge threat to agricultural employers moving forward. Moving into 2024, what can employers do?

Arbitration Agreements

Review your arbitration agreement with your counsel. The agreements are still valuable and, if written appropriately, may provide procedural clarity for both employee and employer in a PAGA case. Be sure your counsel is familiar with agriculture in particular, and if you have H-2A employees, even more reason to review your agreement now to ensure it is keeping up with the ever-changing legal landscape.

Review Wage and Hour Policies and Practices

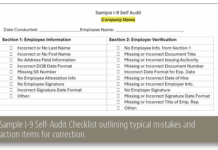

Wage and hour is extremely difficult with a seasonal workforce working in oftentimes remote field locations or packhouses. Look critically at your employee handbook and wage and hour procedures now, including a self-audit, to proactively remedy potential violations. One of the easiest targets is your paystub. Does it include everything that is required under the California Labor Code? Check now.

Workplace Violence

This year, the California Legislature passed SB 553, essentially codifying an earlier Cal/OSHA proposal pushing further workplace violence prevention requirements on California Employers. Under the new law, by July 1, 2024, employers must 1) create and implement an individualized written Workplace Violence Prevention Plan; 2) train employees and supervisors on workplace violence matters; 3) create and maintain a violent incident log; and 4) keep records of all training and violent workplace incidents that occur.

Paid Sick Leave

Just as employers finished navigating the various COVID-19 leave rules and requirements, the California Legislature voted to expand existing Paid Sick Leave benefits. The new law, SB 616, is effective January 1, 2024 and will apply to virtually all employees who work in California for 30 days or more in a year. Employers may still either use the “frontload” or “accrual” methods, but instead of 34 hours or three days of leave, an employer must now provide 40 hours or five days of paid sick leave. Employers should work now to update their accrual or frontload methods including request forms, employee handbooks, written sick leave policies and training materials. Employers should train supervisors, and foremen should be updated on the policy change so they do not inadvertently give out of date information directly to employees. Critically, employers should also check with their payroll processor to confirm the Paid Sick Leave balance is accurately reflected on the employee’s paystub given the change in the accrual/frontload requirements.