Roland Fumasi knows it’s impossible to predict the future. But it’s his job to make sense of the road ahead.

Fumasi is the North American regional head of the RaboResearch Food and Agribusiness group, which Rabobank calls its “knowledge center.” Rabobank is, of course, a global leader in providing financial services for the food and agribusiness sector.

In February, RaboResearch released its “Five-year almond market outlook,” with Fumasi as lead author. Fumasi, who joined Rabobank in 2014, holds a doctorate in agricultural economics from Texas A&M University. Rabobank colleagues David Magaña and Pia Piggott collaborated with Fumasi on the almond outlook.

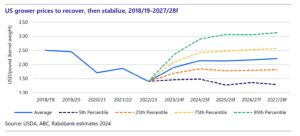

The team looked at current and future market conditions and analyzed various risk scenarios. Their report explores structural changes likely to occur in the almond industry. While the Rabobank researchers highlighted several key factors for improved prices, they zeroed in on what they believe to be the biggest driver.

“What makes the market recovery possible is the significant drop in carry-in this year,” Fumasi told West Coast Nut at this year’s World Ag Expo in Tulare, Calif. “The power of carry-in size cannot be overstated.”

Q. Your bullish price outlook is good news for California’s almond growers. Why do you think almond prices will rebound over the next 12 to 18 months?

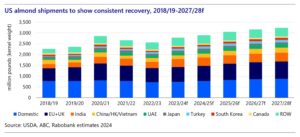

We’ve already seen prices strengthen over the last few months. Part of that is the realization that last year’s almond crop, the 2023 crop, will be a little lighter than the USDA objective estimate of about 2.6 billion pounds. The industry’s now realizing it’s going to be closer to 2.5, maybe even a little shy of 2.5. Another part of the story is that, so far through January, exports are up about 12% year over year. That’s really a positive piece of the story. Those two big drivers mean we’re likely to have a very, very manageable carry-in going into the 2024-25 marketing year.

Q. What amount do you project for the almond carry-in on Aug. 1, 2024?

If we can keep this pace of shipments, which is being led by exports, we estimate we will have a carry-in of somewhere around 500 million pounds. That carry-in number is extremely powerful. It’s essentially known on day one of the marketing year, so it starts to play into the mentality of sellers and buyers. When you start with a low carry-in, sellers aren’t under as much pressure versus when they have a big carry-in. In the last two seasons, we’ve had 800 million pounds plus. A 500-million-pound carry-in is extremely manageable. We think there will also be some recovery in domestic shipments in the coming couple of seasons. We think recovery will start this next season.

Q. Your average estimate for California’s 2024 almond production is at just above 3.1 billion pounds, basically in line with the 2020 record. Can you explain?

We think the trees have the capability in 2024, given their age, to again produce a 3-billion-plus-pound crop. That’s assuming favorable weather and more snow for plenty of irrigation water. I will tell you, though, that number is the most controversial piece in our report. We’ve had some people tell us they don’t think bearing acreage is actually as high as we think it will be over the next year or two or three. They point out that it’s been a painful few years and growers have been so cash-strapped that they may not push everything into the trees that’s needed to get the kind of yields to produce a 3-billion-pound crop. We acknowledge there’s always more downside yield risk than upside, and a lot of weather to happen between now and this summer. The risk in these estimates is well documented in our report.

Q. What do you see for almond production through 2028?

We think yields are going to stabilize at right around 2,200 to 2,300 pounds per acre. Bearing acreage will stabilize at just above 1.4 million acres. When you combine those two factors, that means production will stabilize at around 3.2 billion to 3.3 billion pounds. We think the industry can market that amount of almonds and still keep a much better price than we’ve seen over the last few years. Under that scenario, we see price at $2.15 to $2.20 a pound, which is much more favorable than the $1.40 we saw last year.

Q. Why do you expect domestic almond shipments to reach a record high by 2025-26?

Domestic demand, just like exports, has fallen off the last couple years. Part of that has been due to this high inflationary environment, which impacts consumers. We have to remember the almond industry has done a phenomenal job of stimulating almond demand. Almonds’ healthfulness, convenience and eating profile combine super powerful forces. And there’s the plant-based health trend. Almonds check those boxes very well. But in an inflationary environment, people have to make choices. That’s weighed on almond demand, not just in the U.S. but globally. As we get into a more normal inflationary environment, that pressure gets released.

Q. What’s behind your belief that U.S. almond exports will continue to grow, including double-digit growth for 2023-24?

We’re halfway through the marketing year and exports are up 12%. And we’re assuming that trend of solid growth, in the mid-single digits, will continue. There are the same drivers as we see for domestic growth and an additional one for exports: continued rising incomes in developing countries around the world. That’s super powerful.

Q. Despite its overall positive outlook, your report doesn’t ignore the significant risks that California almonds face over the next five years. What are the biggest risks ahead?

Geopolitical tensions are on the rise, with an escalation of global conflicts. Logistical concerns are always looming. Low water levels in the Panama Canal are reducing shipping capacity. We’re seeing container availability issues and rising shipping costs due to the disruptions in Red Sea maritime traffic. Upside energy-price volatility is likely. On the production side, there is more downside yield potential from negative weather shocks and potential water constraints. There’s the increased risk of overplanting as prices recover. And there is ever-growing competition in the tree nut space.

Q. What’s the biggest takeaway from your report?

We are already seeing some recovery in almond price to the grower, and we expect to see even more upside recovery to price. Price will get back to a level where many almond producers will be able to break even at a minimum. We’re not talking about huge profits in almonds, but at least we get almond pricing back to a level where these operations can much more easily cash flow. That’s the biggest takeaway.

Find the full report at https://research.rabobank.com/far/en/sectors/fresh-produce/five-year-almond-market-outlook.html.